A couple of days ago, Fifth Person dropped my interview about F.I or F.I.R.E on YouTube:

It’s mad that there were only ten working days between the interview and the video drop. And this is coming from someone working in a company trying to drop videos as well.

Honestly, I didn’t get good vibes about this interview because of how I reviewed my performance on my way home. That caption the team designed made me wonder what kind of negative comments we would get.

The most fitting word to describe the feedback was gratitude.

I didn’t dare to watch the video until yesterday night. I really spoke too fast despite always telling myself to slow down. It is challenging to be succinct. My colleague Chin Yu and I were discussing structuring some of the tougher responses. It boils down to using the right words that are simple enough yet squeeze enough meaning into them.

But I also believe we need to explain some of the nuances sometimes because what would really help people with more understanding is sometimes not the simple things but that you experience the same difficulties, and have your own interpretation and possible solutions for it.

Despite the fumble almost all except one comment was encouraging. Sometimes I do not know what I do to deserve this show of support.

Perhaps it is because I try my best to tell it as it is.

Here are some potential elaborations on some of the points discussed.

Defining F.I. and Whether I Qualify to Dish Out Advice on the Subject

I shared my definition of F.I. and F.I.R.E., which will likely differ from how people would define it conventionally. Have money and buy the lifestyle you desire.

To many, FI means work is optional. I don’t have a problem with that definition but I do think many really wish they had $10 million so that they don’t have to work and retire. That is not wrong but I feel that the body of work should be about defining the lifestyle you wish to buy for.

Many get the money and end up having a hole within because they have no idea what they want to do in life after that.

The guys thought it was a good idea to talk about what Providend is and what I do there as it makes what I am about to share about F.I. or F.I.R.E. relatable.

But it got me thinking about a question which I eventually asked my Telegram group:

Do you need to be financially independent or close to it to qualify as a financial planner and help people plan for their financial independence?

Some are of the opinion that they should, or be more fervent about it

If not, wouldn’t it be blind leading the blind?

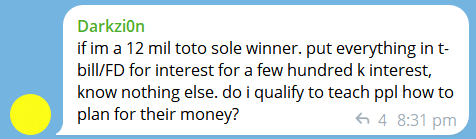

Darkzi0n brought up a good point:

You can have so much more money than you really need so that your plan works, but that doesn’t mean you know enough to teach.

But lately, I agree more that you need to be fervent about F.I. or F.I.R.E. more to help people plan.

The main reason: Those who feel the urgency more can “detect” more problems/considerations, problems/considerations that those who are not on the path might not be about to “feel”.

If they cannot detect or feel, they might brush things off easily.

But it is important to recognize that you don’t have to be fervent on the path of F.I. if technically, you have a very sound F.I. planning framework.

At this moment, I think nobody cares about your plan more than yourself.

Do I qualify for advice about it?

I think I am qualified to advise about it, not because I work in an official capacity, but because I spend enough of my waking (and sometimes sleeping) hours thinking about different facets of F.I. If we are focused on a subject, you will notice more weakness, strengths, and considerations.

You don’t need an official certification to play DOTA well, you just need to be immersed in it more than the average person.

How I Frame My Portfolio Mentally Going Forward and Why I Shared My Portfolio

They talked about my portfolio being a zoo and why it is that way. And why does my portfolio have “so many bonds”.

I think my friends at Fifth Person are more accustomed to a cash/equity portfolio mix. I am not surprised people look at my portfolio as a zoo because those were common comments even years ago. I put up my portfolio about ten years ago in 2013, because I came up with this Google Spreadsheet that records your portfolio based on buy, sell, and dividend transactions. You cannot find such a spreadsheet back then. Today, maybe you cannot find such a spreadsheet other than mine if I am right.

So over the past ten years those positions I sold, they remain on the spreadsheet because we need to keep the transactional records. We cannot easily hid transactions without any units/shares like custom software.

I explained that, in my mind, it is not as complicated as last time.

On a high level:

- Equities (77%)

- Bonds/Cash

Much of the returns will be driven by the equity risk premium or the proven returns of equity over a risk-free rate over the long term.

The bonds are unique in that the longest duration of the bond fund is 6-7 years, so if I kept it longer than that, the returns would be positive. Also, because they are diversified, the bonds dampen the volatility.

The optimal allocation for spending down (or withdrawal) is between 40%-80% equities. Having a portfolio of 100% equities will have a good outcome in a poor market and inflation sequences but not as good as an 80% equity allocation based on empirical research.

The equities are split into:

- Global Equities (57%)

- US Small Cap Value (40%)

- A few small Emerging Markets, Sectoral positions (5.5%)

If I had the choice, I would be in Global Small Cap Value, but we will see how it goes. Global diversification has not done well recently, but I prefer a portfolio not always about empirical evidence but with more humility that tries to be a “I-don’t-know-what-will-happen” portfolio.

To be honest, that volatile small-cap value position is a tad big but we will see if my heart can take it.

A few factor funds made up the global equities portion, but generally, the market risk premium will still drive most of the return. If equities die, unless in unique market sequences, the factors will not save the portfolio much.

The portfolio is also the bulk of my net wealth.

In my mind, I am done adding more capital to the portfolio except for SRS monies because I added to the portfolio in the past and it will be weird to divert the money away. This portfolio… at this point, will live and die by the market and will be volatile.

It is many times the salary, such that if it falls 50%, only the market will save the portfolio. This will be a test of my investment psychology.

In a way, my portfolio is a real-life peek into whether what I have shared will work or will crash and burn.

Deep down, I genuinely believe this strategic, low-cost, globally diversified, 80-60% equity strategy can give perpetual inflation-adjusted income if we respect the initial income spent relative to the portfolio value (keep it 2.5% or lower).

There are enough sceptics wondering:

- Can you get income from something that does not pay a dividend?

- Can investing be that systematic and passive?

- Can you remove market return uncertainty and get inflation-adjusting income by respecting the safe withdrawal rate?

- Can I express my more tilted investment philosophy but be more passive about it?

There are enough advisers, planners, and investment professionals who recommend something and don’t eat their own cooking. You can say you invest in your recommendation, but putting 2% of your net wealth into it also qualifies as you “believe” in what you recommend.

No promises, but I am going to try and eat my own cooking.

And everyone can watch whether I do okay or I burn down.

How to Gain Confidence to Switch from One Wealth Machine to Another

We also discussed about my time doing dividend investing.

What made me transition from one wealth strategy to another?

In order to do that, you need to dig deep enough to find some investment strategy that is better and more suitable for you. I realize the ability to dig deep to figure out how an investment strategy work, its pros and cons, how much effort realistically we need to spend in order to make it into our wealth machine, is such a rare skill. Initially, I thought it should not be so hard for people to do this and then I realize… only a handful of people could.

The key is not many sacrifice and commit enough time and mental space to solely think about one thing.

The Most Unheeded F.I. Tip I Will Explain Again

I also shared my tips for people interested in reaching F.I or F.I.R.E:

- Ensure you Earn More, Optimise your Expenses, and Invest Wisely with the Surplus you have. Read this article on the Wealthy Formula.

- Figure out your Desired Lifestyle.

The second tip is so, so underrated and not the first thing people discussed.

But it will either disappoint you or boost your morale.

I give you an example.

In some parts above, I mentioned that if you keep your initial income to the portfolio value or initial safe withdrawal rate lower than 2.5%, the inflation-adjusted income stands a very, very high possibility to be intergenerational (unless your next generation fxxks it up).

If you know what you want and you want $5,000 a month, then you need ($5,000 x 12)/2.5% = $2.4 million.

If you REALLY don’t know your lifestyle, and don’t know what you want, then you guess you need $8,000 when you F.I.R.E, then you will need ($8,000 x 12)/2.5% = $3.8 mil. That is $1.4 million or 50% more.

What may be the difference? Actually, maybe that person who thinks he or she needs $8k actually needs $5k. If he or she is high income, then still okay can earn $1.4 mil in a short span. But fxxk, that is $1.4 mil more.

You can question the robustness of this 2.5% safe withdrawal rate, but I can replace it with another ratio, like 1% or 6%, and the math will remain the same.

Building on to that example, if you realize that you can be flexible with half of that $5,000 monthly, or you are not immortal and don’t care about your next generation, you could work with 3% or 3.5% and you will need ($5,000 x 12)/0.035 = $1.7 mil or $700k less.

This money difference equates to years of work, years of work stress that you might not have to endure.

So what characteristics of the desired lifestyle do you need to think about?

- Which spending do you care more about than the others and which you care less about?

- Which spending do you spend today will go away in your desired lifestyle?

- Which spending do you don’t or pay for today that you will eventually pay for?

- How flexible or inflexible is each of your spending?

You have 10-15-20 years to pay attention to what you like or dislike to figure this out and this impact your FI journey.

But how many would do this?

I suspect not much because we are more focused on money accumulation and other easier things to thing about.

Last Words

Again, I would like to thank those of you who watched the video. I should probably get back to doing some of the videos myself but my desktop setup is currently in transition and video production is a bit difficult.

But if you have watched the video and have some topics around F.I., Financial Planning, or Income planning that you want Fifth Person to discuss, do let me know in the comments here or in my Telegram.

I invested in a diversified portfolio of exchange-traded funds (ETF) and stocks listed in the US, Hong Kong and London.

My preferred broker to trade and custodize my investments is Interactive Brokers. Interactive Brokers allow you to trade in the US, UK, Europe, Singapore, Hong Kong and many other markets. Options as well. There are no minimum monthly charges, very low forex fees for currency exchange, very low commissions for various markets.

To find out more visit Interactive Brokers today.

Join the Investment Moats Telegram channel here. I will share the materials, research, investment data, deals that I come across that enable me to run Investment Moats.

Do Like Me on Facebook. I share some tidbits that are not on the blog post there often. You can also choose to subscribe to my content via the email below.

I break down my resources according to these topics:

- Building Your Wealth Foundation – If you know and apply these simple financial concepts, your long term wealth should be pretty well managed. Find out what they are

- Active Investing – For active stock investors. My deeper thoughts from my stock investing experience

- Learning about REITs – My Free “Course” on REIT Investing for Beginners and Seasoned Investors

- Dividend Stock Tracker – Track all the common 4-10% yielding dividend stocks in SG

- Free Stock Portfolio Tracking Google Sheets that many love

- Retirement Planning, Financial Independence and Spending down money – My deep dive into how much you need to achieve these, and the different ways you can be financially free

- Providend – Where I used to work doing research. Fee-Only Advisory. No Commissions. Financial Independence Advisers and Retirement Specialists. No charge for the first meeting to understand how it works

- Havend – Where I currently work. We wish to deliver commission-based insurance advice in a better way.

The post Gratitude, My Portfolio, and My Qualification to Advice on F.I. appeared first on Investment Moats.