Solar power is a key component of the transition to renewable energy.

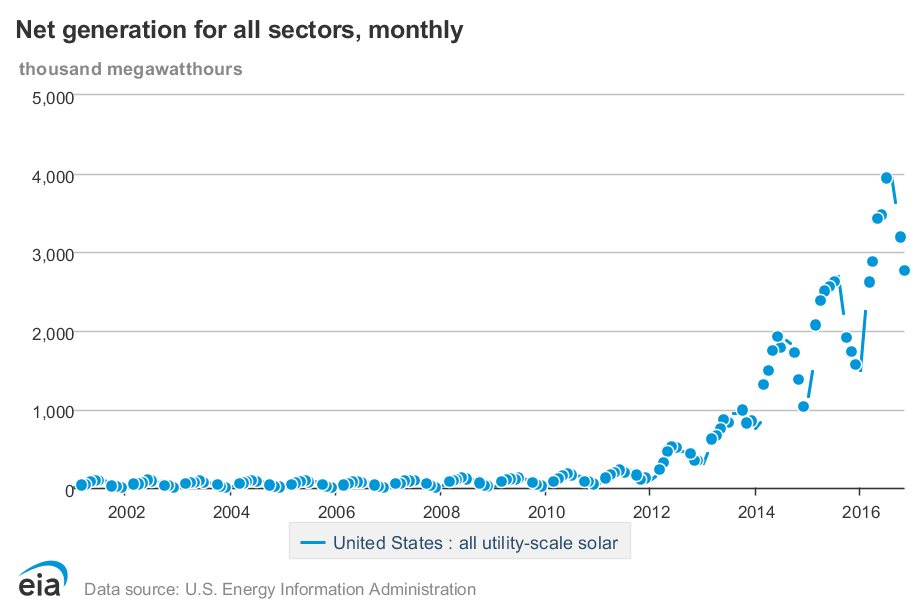

One reason is that it is relatively “easy” renewable energy. It does not generate the opposition and the “not in my backyard” reaction that windmills often produce, and it can be implemented almost anywhere. As a result, US solar production has risen dramatically in the last 10 years.

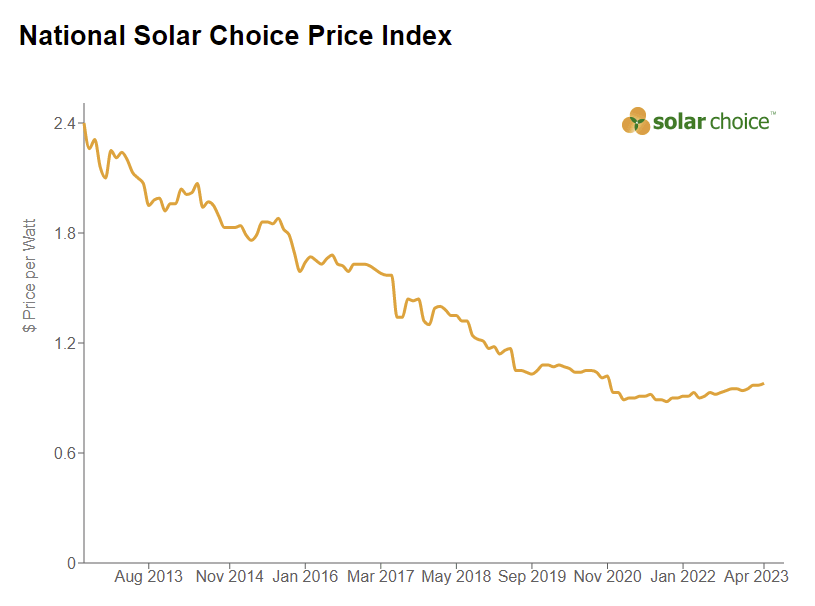

The second reason is constantly decreasing costs. The price per watt is less than half of what it was just 10 years ago.

In the last few months, inflation and high material costs have stopped this advance. Nevertheless, further technological progress is likely, supporting even cheaper costs in the future.

We will focus on photovoltaic companies (producing power from sunlight), but if you are interested, you can also learn more about concepts like thermal solar power or even agrivolatics (farming + solar power).

Best Solar Stocks

Let’s take a look at an array of different solar companies able to capture the changes happening in our energy system.

These are designed as introductions, and if something catches your eye, you’ll want to do additional research!

1. First Solar, Inc. (FSLR)

| Market Cap | $21.31B |

| P/E | – N/A |

| Dividend Yield | – N/A |

First Solar is a US-based manufacturer of solar panels (the largest in the US), with manufacturing facilities in the US, Vietnam, and Malaysia.

Its unique advantage is a focus on more advanced thin-film photovoltaic, in contrast to the classic crystalline silicon panels. Increased polysilicon prices are playing a big part in the pause in cost/W decline, so this can prove a valuable advantage.

Thanks to a high recycling rate and using mining byproducts as components for its panels, First Solar is a very green company, even when compared to other panel makers.

The company is also positioned to gain from any trade dispute between China and the USA, as China is manufacturing 65-80% of all solar panel components.

2. Brookfield Renewable Corporation (BEP / BEPC)

| Market Cap | $5.69B |

| P/E | 3.76 |

| Dividend Yield | 4.01% |

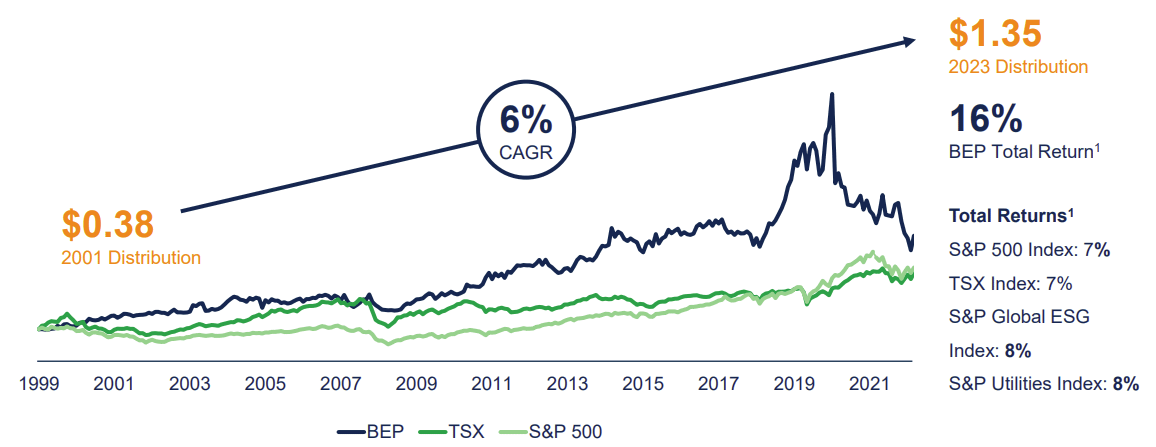

Brookfield is a large operator of renewable energy facilities (25GW), including solar, wind, and hydropower, with a pipeline of 110 GW planned. Brookfield Renewable Corporation is part of the larger Brookfield Group, with $800B under management.

The bulk of the capacity in development is in solar (60GW). The company expects to deploy $6-7B in the next 5 years.

Brookfield is a utility company with a growth profile. Over time, it is expected to keep growing its dividend payments and its stock price out of its growing operational cash flows.

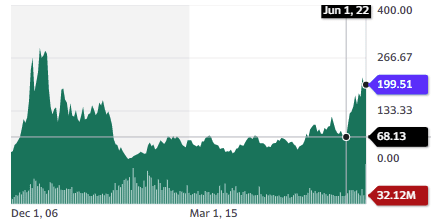

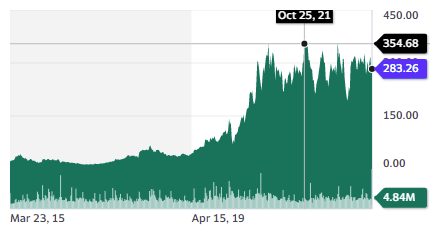

3. Daqo New Energy Corp. (DQ)

| Market Cap | $3.17B |

| P/E | 1.82 |

| Dividend Yield | – N/A |

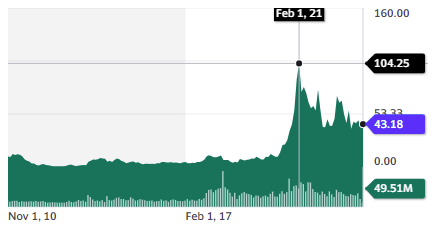

This is a Chinese company that is one of the leaders in polysilicon production, with one of the lowest cost structures. It is producing the basic material for making solar panels assembled by others and is one of the foundations of China’s domination over the sector.

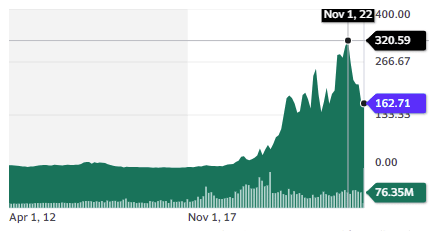

It massively benefited from the solar boom of 2022, with revenues reaching $4.6B, from $1.6B in 2021 and $0.68B in 2020. Q1 2023 revenues might indicate a trend toward revenues in the upcoming year at half of 2022’s (which would still be a 40% increase from 2021’s revenues).

This can be controversial stock, as the company is reportedly tied to the use of forced labor in Xinjiang, with assorted sanction risks. So it carries a significant geopolitical risk but also trades a very low multiple because of that.

4. JinkoSolar Holding Co., Ltd. (JKS)

| Market Cap | $2.29B |

| P/E | 23.60 |

| Dividend Yield | – N/A |

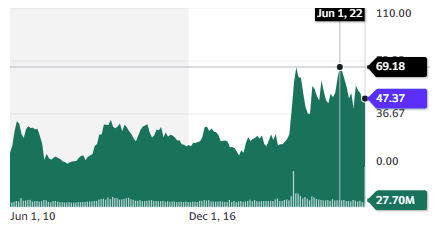

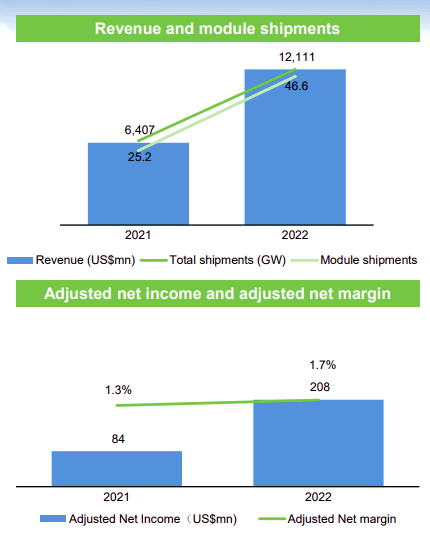

The Chinese manufacturer of solar panels has delivered a cumulative total of 130 GW of solar capacity all over the world. Its annual shipments in 2023 are expected to reach 60-70 GW, reflecting the tremendous growth of the market and HJKS production capacities. Its manufacturing is located in China, the USA, Malaysia, and Vietnam.

Like other solar companies, its revenues doubled between 2021 and 2022.

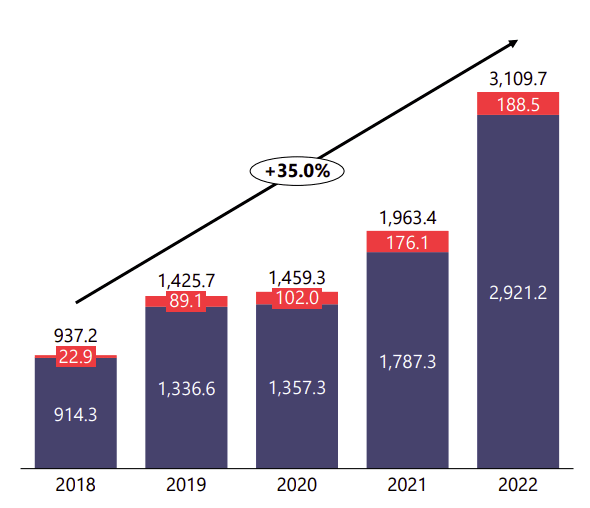

5. SolarEdge Technologies, Inc. (SEDG)

| Market Cap | $15.6B |

| P/E | 166.85 |

| Dividend Yield | – N/A |

The Israeli company specializes in inverters and power systems for solar installations, as well as related software and batteries. It is the largest inverter company by revenue and has shipped 4.5 million inverters in total.

It can offer solutions both for home installation and commercial-scale solar production. It is currently developing a utility-scale offering to provide batteries to stabilize the grid and store solar power for peak consumption hours.

Like most solar companies, this is a growth story with a net acceleration in 2022.

The company has expanded through organic growth, as well as acquisitions and investments:

- In Kokam, a South Korean provider of Lithium-ion battery cells, batteries, and energy storage solutions in October 2018.

- In SMRE – an Italian EV powertrain manufacturer, in January 2019.

Its extension in electric mobility has started well, with SolarEdge selected as a supplier of electric powertrain units and batteries for the Fiat E-Ducato (Stellantis).

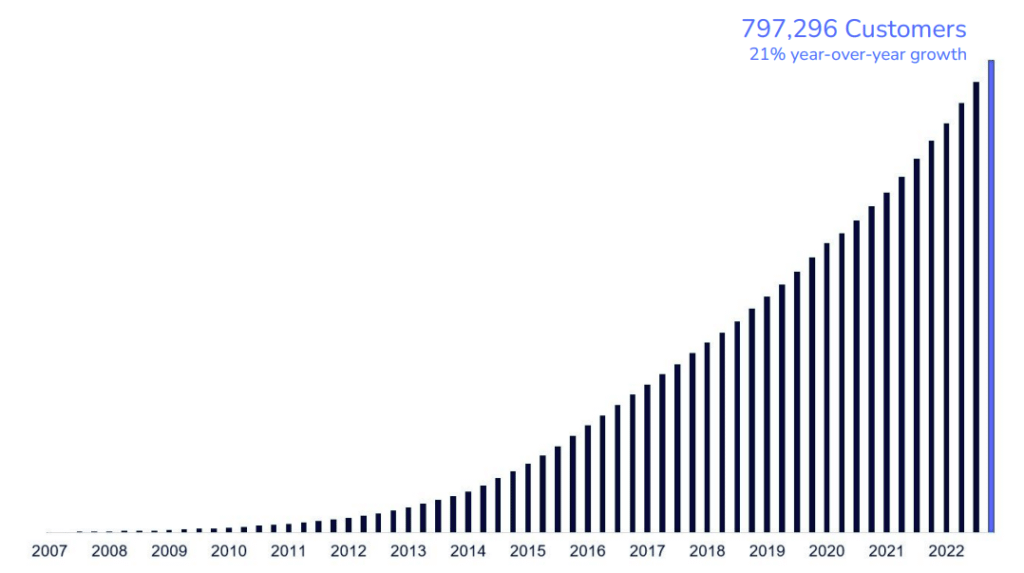

6. Sunrun Inc. (RUN)

| Market Cap | $4.3B |

| P/E | 23.96 |

| Dividend Yield | – N/A |

SunRun is the #1 residential solar company in the US, following its merger with Vivint Solar in 2020. Its unique offering is a leasing option for consumers instead of just selling the panels directly.

It is currently getting close to 800,000 customers, with a 21% year-to-year growth.

The company also launched a “virtual powerplant”, using its network of privately-owned batteries and solar systems to coordinate the release of energy in the grid with PG&E.

It also has a partnership with Ford for installing a network of EV charging stations.

Higher interest rates could be a threat to the company. What is mitigating it is that the electricity utility rate is also growing quickly, giving the company some breathing room on its pricing.

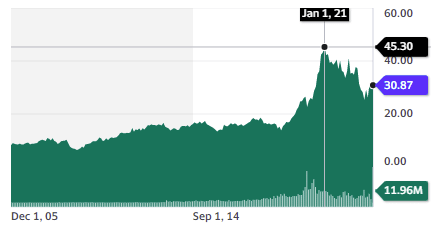

7. Enphase Energy, Inc. (ENPH)

| Market Cap | $30B |

| P/E | 80.30 |

| Dividend Yield | – N/A |

Another leader in inverters, EV chargers, and batteries for solar systems, Enphase has sold a total of 3.3 million systems in 145 countries.

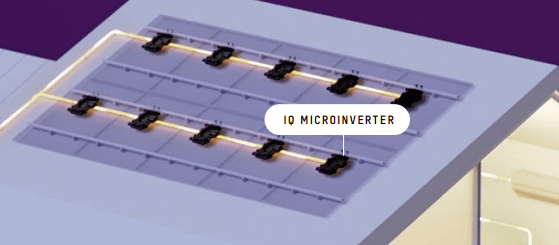

Enphase uses semiconductor micro-inverters instead of the classic string inverter technology with one central inverter. This allows for a more flexible, controllable, cheaper, and safer design of the inverter.

The company has a capital-light model, with contract manufacturing for its products.

In the last 2 years, Enphase has made a series of acquisitions in the broader solar ecosystem.

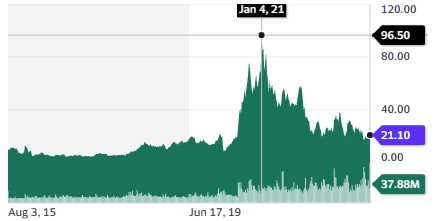

8. Sunlight Financial Holdings Inc. (SUNL)

| Market Cap | $55.4M |

| P/E | – N/A |

| Dividend Yield | – N/A |

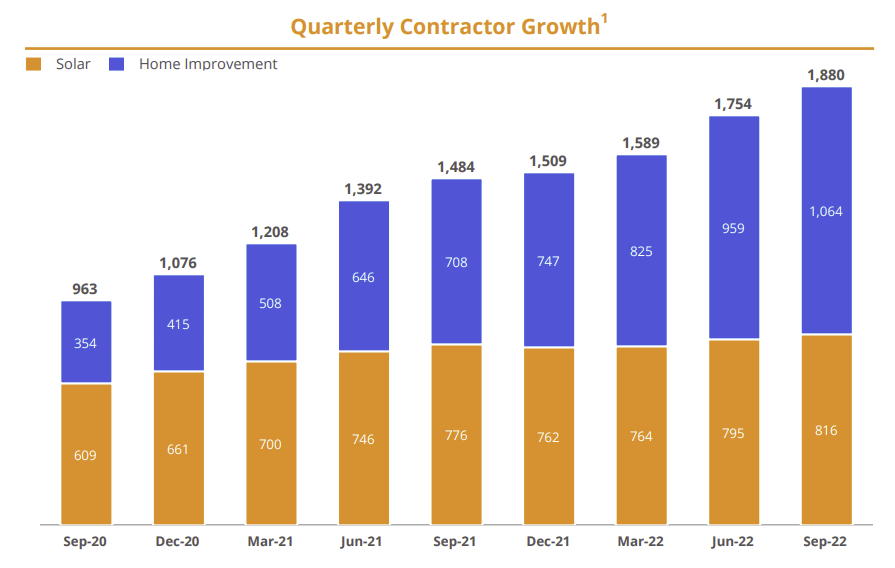

Sunlight is a financing platform for funding solar installations. It has funded a total of $7B in loans to more than 70,000 customers, with an average loan of $42k.

As a platform, Sunlight does not directly provide loans but links loan providers (like a large bank) and the customers taking the loan, often following the recommendation of their solar installer. Sunlight earns a fee of $1k-$2k on each transaction.

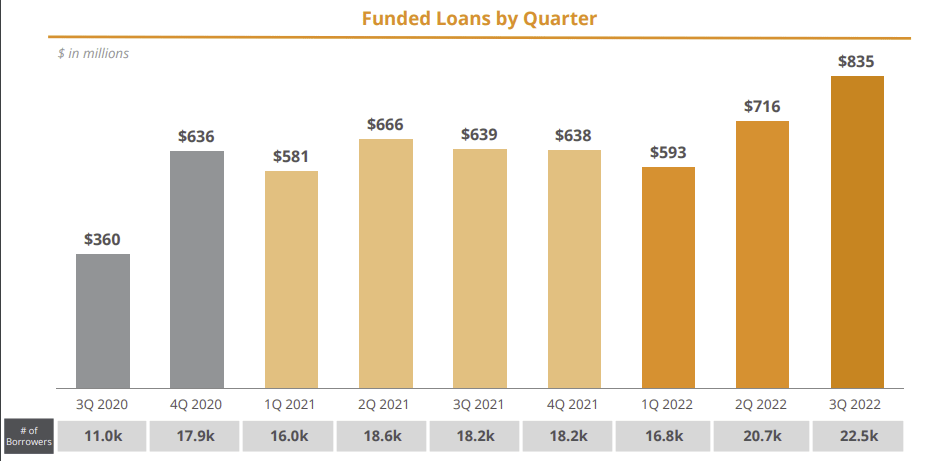

The growth of its contractor network, the primary source of new clients, has been steady:

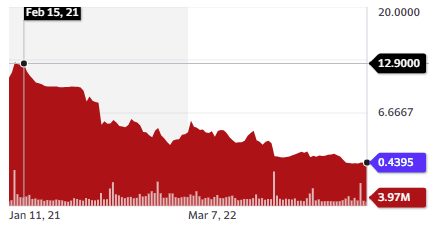

After a period of decline in late 2021, the business has picked up again in Q2 2022 & Q3 2022.

The company got caught in the recent US banking turmoil. It had a revolving loan with Silicon Valley Bank and has recently signed an agreement with Cross River Bank to increase its liquidity and its balance sheet.

Rising interest rates could be a threat to this company, as it makes loans for solar panels more expensive. Alternatively, the company might benefit from the green agenda in the Inflation Reduction Act.

Investors might want to look closely at the balance sheet, with a stash of cash of $91M for just $23M in total current liabilities. The total assets of $1B compared to $123M in total liabilities and a market cap of just $55.4M could indicate a mismatch in the stock price and its assets’ value, triggered by liquidity fears and the overall banking turmoil.

Best Solar ETFs

In a sector growing as quickly and moving as fast as solar (it barely existed a decade ago), diversification can be very important. So you might be interested in ETFs targeting the sector as a whole.

(Many ETFs classify solar panel and inverter companies as IT/tech companies, which can be confusing considering the industrial nature of most of these businesses).

1. Invesco Solar ETF (TAN)

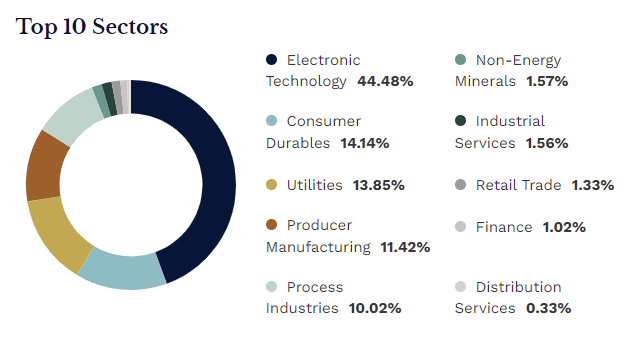

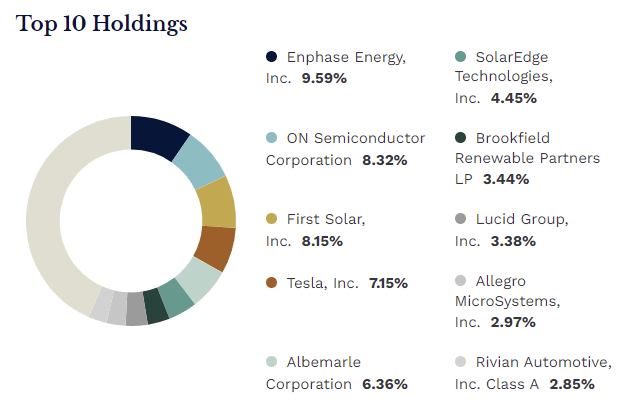

The ETF’s top 3 holdings are First Solar, SolarEdge, and Enphase Energy. It also has several Chinese manufacturers in its top 10 holdings.

20% of the ETF is invested in utilities and 74% in IT/industrial + manufacturers/sellers of solar systems.

2. Global X ETF (RAYS)

The fund is exclusively focused on industrial and IT/manufacturers of solar systems, with only 5.7% invested in utilities. The top 3 holdings are First Solar, SunGrow Power, and Ja Solar.

3. First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

This renewable energy ETF is investing in solar stocks but also utilities, EVs, and lithium mining.

This is a better choice for investors looking for wider exposure to green energies as a whole. The top 3 holdings include solar companies Enphase Energy and First Solar. The 4th largest holding, Tesla, is also active in the sector, even if its primary activity is in EV production.

4. Invesco WilderHill Clean Energy ETF (PBW)

This fund invests in solar technology, with Maxeon Solar, FTC Solar, and Sunrun among the top holdings. It also invests in electric mobility (including electric-powered planes and Vertical Aerospace). Around 43% of the fund is in industrial companies, 12% in materials (lithium), and 9% in utilities.

So this is a green energy ETF providing exposure to the whole supply chain, from the mine to the finished battery and solar panel and electric mobility.

Conclusion

Solar as a power source is here to stay. It is still a very new sector with a lot of innovation and growth potential.

Special attention will need to be paid to diversification and not overpaying for growth, as well as checking that new technologies or changes in the economic environment (including subsidies) do not threaten a company’s business model.

The post 12 Best Solar Stocks & ETFs In 2023 appeared first on FinMasters.

Best Solar Stocks

Best Solar Stocks