On that note, the credit ratings agencies have now been injected into the conversation. In my prior debt ceiling-related blog post earlier this month, I mentioned how as recently as March of this year, S&P Global Ratings affirmed the U.S. AA+ rating with a stable outlook. That was more than two months ago, and now we have Fitch Ratings weighing in on the subject last week. While the actual AAA rating for the U.S. remained unchanged, Fitch did downgrade the outlook to “negative watch” due to the dysfunction occurring in the debt ceiling process.

The more widely followed Moody’s Investors Service also weighed in on the matter. The Aaa rating and “stable” outlook are still being maintained, but if the upcoming June 15 interest payment were missed, the rating agency would downgrade the US rating one notch to Aa1. Interestingly, both Fitch and Moody’s expect a debt ceiling deal, but the two ratings agencies have taken somewhat different approaches. For Moody’s, it appears as if the more important criterion is an actual default of debt service, whether it be principal or interest, while Fitch appears to be focusing more “on the process”.

That takes us back to the 2011 episode, one which has some intriguing similarities to the current debt ceiling chapter. Ultimately, the Democrats and Republicans came together and produced the Budget Control Act (BCA) of 2011, which ended up increasing the debt limit. However, the BCA was too little, too late, as S&P still decided to downgrade the U.S. credit rating a notch to AA+ on August 5, 2011, only days after the legislation was signed into law. The move reflected S&P’s opinion that “political brinksmanship” was making “America’s governance and policymaking becoming less stable, less effective and less predictable.”

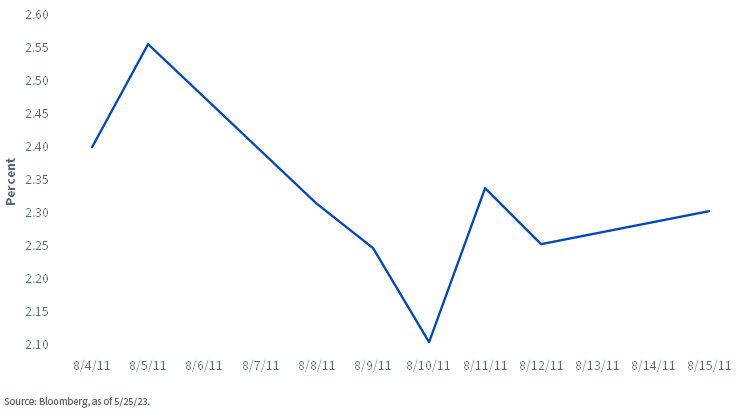

U.S. Treasury 10 Year yield

So, how did Treasuries (UST) respond to the 2011 downgrade? Conventional wisdom (including yours truly) thought yields, such as that for the UST 10 Year note, would go up. Intuitively, one would think that a credit downgrade would not be a positive development. However, a visible risk-off reaction ensued following the downgrade with the S&P 500 falling nearly 7% in the immediate aftermath. Meanwhile, despite the negative credit rating action, Treasuries were still viewed as the global safe-haven investment, and the UST 10 Year yield actually plunged 45 basis points in the days that followed (see graph).

Conclusion

Certainly, past is not necessarily prologue, but as we’ve seen in the past, the rating agencies can still act even if there’s a debt ceiling agreement, especially if the focus is more on the “partisan/dysfunctional process”. Given the uncertainties surrounding the debt ceiling saga, sometimes looking at current headlines juxtaposed with historical events can provide some useful context.

]]>