The global hesitation is fair, given that international stocks have been a downright disappointment for the last 14 years since the global financial crisis.

Case in point: an investment of $100 in U.S. equities1 made in March 2008 would have grown, assuming reinvested dividends, to $422 by March 2022. The same investment in international equities2 would have left you only $155.

Going back even further, to the inception of global MSCI indexes in 1970, U.S. equities have been the clear winner, delivering an annualized return of 10.5% compared to only 8.4% for international.

U.S. vs. International Annualized Returns, 1970–Present

However, the U.S. hasn’t always been the obvious winning trade. In fact, if you were to do the same analysis in 2008, you would have come to a different, potentially even opposite conclusion.

U.S. vs. International Annualized Returns, 1970–2008

Clearly this most recent period of U.S. outperformance since 2008 has had a notable impact on long-term returns. Yet it is not unprecedented for one country or region to have its moment in the sun. Other notable examples include Japan in the 1980s and emerging markets in the 2000s.

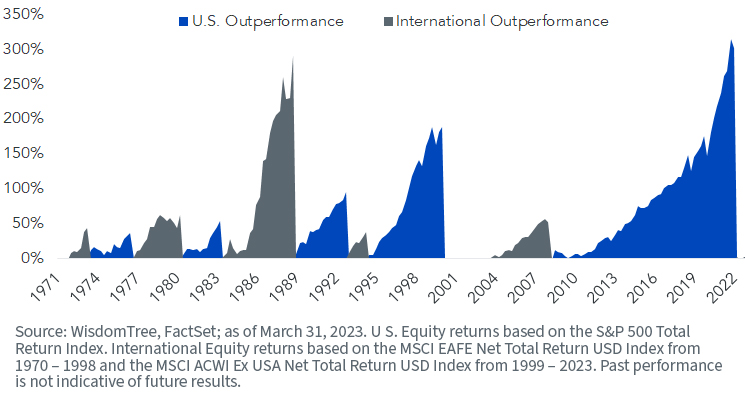

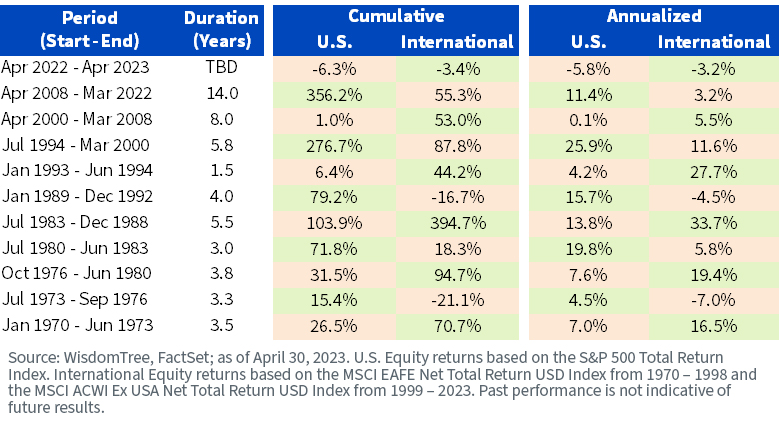

The result of these performance cycles is that, since 1970, U.S. equities have had long cycles of positive and negative returns relative to international stocks.

Period of U.S., International Equity Outperformance (1970–Present)

It is easy to discount this longer-term perspective when most investors and clients are focused on recent results. Indeed, an entire generation of investors today has only experienced a world where U.S. stocks consistently outperform. Recent episodes where the international trade has worked were fleeting and inconsequential.

But there is no shortage of historical examples where U.S. equities have underperformed the rest of the world dramatically, and for extended periods of time.

Periods of U.S., International Equity Outperformance (1970–Present)

It is impossible to predict how long this incredible run for domestic stocks can continue. And the past several quarters of international outperformance suggest the tides could be turning.

One thing is for certain—it can’t go on forever. A common trait of all these historical cycles is that they eventually end.

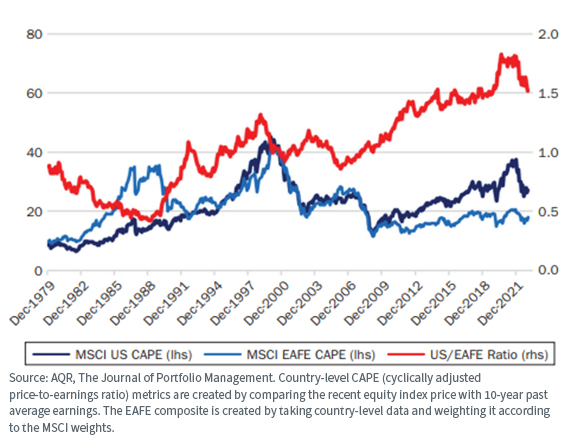

U.S. Equities Priced at a Premium

What is behind the recent success of the U.S. market, and can it sustain itself? A recent paper by AQR Capital Management in the Journal of Portfolio Management suggests that, outside of currency movements, the outperformance was predominantly driven by higher valuations, and not fundamentals.3

After the global financial crisis, cyclically adjusted earnings multiples of U.S. and international equities were roughly the same. By the end of 2022, investor demand for U.S. equities had pushed their valuations to approximately 1.5 times that of international stocks.

Valuations of U.S. and Other Equity Markets, Jan 1980–Feb 2023

For definitions of terms in the graph above, please visit the glossary.

In other words, the U.S. market is now much more expensive relative to the rest of the world. This makes its recent outperformance inherently less repeatable unless corporate earnings can significantly outpace international markets going forward. And it certainly challenges the idea that historical outperformance will simply carry on unchecked.

Some have made the point that the higher price for U.S. stocks is warranted due to superior innovation, trusted institutions and world-class legal protections.

That may all be true, but at some point, that premium should be fully “priced in” by the market. Simply being the worthiest destination for investor capital cannot justify ever-expanding multiples on the same fundamentals.

Diversification When You Need It

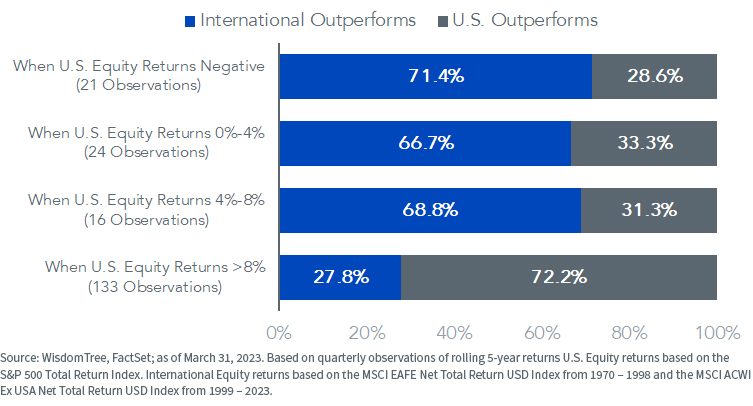

The primary motivation for most investors when allocating abroad is simple: diversification.

While that sounds great, in today’s globally interconnected economy, can international equities really mitigate risk?

It’s clear that during a market crash the short-term performances of regional equity markets tend to become highly correlated. However, over longer time horizons, international equities can help reduce the severity of large drawdowns and expedite the time to recovery.3

This is partially attributable to the fact that international equities have done best when needed most—in times when domestic equities have struggled.

Rolling 5-Year Returns, U.S. vs. International, 1970–Present

For many investors and their advisors, this ability to protect on the downside and rebound from a major market stress is critical to achieving long-term goals.

It is never easy to invest (or stay invested) in something that has struggled for so long. That said, we see a clear case for non-U.S. equities both strategically in the long term and tactically in the near term.

One characteristic we recommend investors focus on when investing abroad is quality. We often define quality companies using a mixture of profitability and efficiency measures such as return on equity (ROE), return on assets (ROA) and leverage.

Our international quality dividend growth strategies expand on this framework, focusing on forward-looking dividend growth potential by selecting dividend payers with attractive measures of profitability and growth.

For investors seeking exposure to international equities with a higher quality profile than traditional market-cap-weighted indexes, the WisdomTree Global ex‐U.S. Quality Dividend Growth Fund (DNL), WisdomTree International Quality Dividend Growth Fund (IQDG) and WisdomTree International Hedged Quality Dividend Growth Fund (IHDG) all offer broad exposure to dividend-paying companies with growth characteristics outside the United States.

DNL invests in both developed and emerging markets outside the U.S., while IQDG focuses specifically on the developed international world. IHDG provides exposure to this same developed international market while also hedging foreign currency risk.

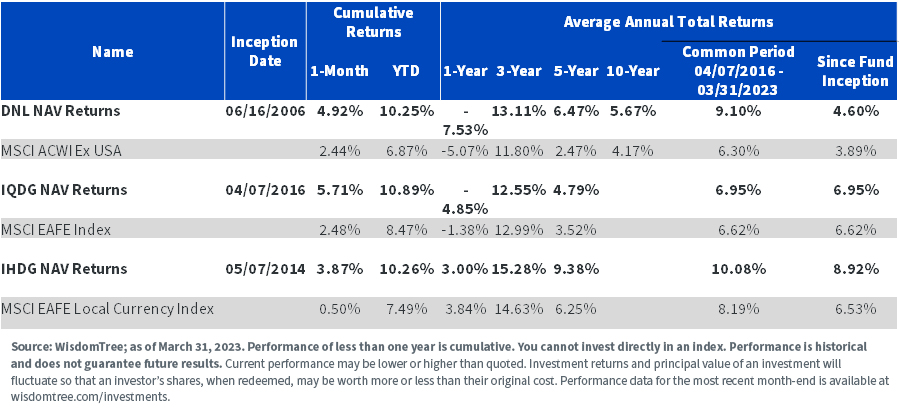

To help illustrate the impact of the quality dividend growth approach, below is standardized performance (as of March 31, 2023) for the underlying WisdomTree indexes that each of the above Funds is designed to track, as well as a comparable market cap-weighted benchmark.

Standardized Performance, as of 3/31/23

WisdomTree Global ex-U.S. Quality Dividend Growth Index is tracked by the WisdomTree Global ex‐U.S. Quality Dividend Growth Fund (DNL).

WisdomTree International Quality Dividend Growth Index is tracked by the WisdomTree International Quality Dividend Growth Fund (IQDG).

WisdomTree International Hedged Quality Dividend Growth Index is tracked by the WisdomTree International Hedged Quality Dividend Growth Fund (IHDG).

1 As measured by the MSCI USA Net Total Return USD Index

2 As measured by the MSCI AC World ex US Net Total Return USD Index

3 C. Asness, A. Ilmanen and D. Villalon, “International Diversification—Still Not Crazy after All These Years,” The Journal of Portfolio Management, June 2023, 45 (6).

]]>