Who else is having a belief a have a look at NZD/USD sooner than the RBNZ’s decision?

While you occur to are, then you definitely definately’ll are eager to peek this 1-hour setup sooner than the occasion!

Sooner than transferring on, ICYMI, the day outdated to this’s watchlist regarded at NZD/CAD’s short-timeframe range resistance earlier than the U.S. session. Draw apparent to ascertain out if it’s restful a applicable play!

And now for the headlines that rocked the markets throughout the final trading lessons:

New Market Headlines & Financial Records:

U.S. New House Sales for October fell -5.6% to 680Ok objects (-4.0% m/m forecast; 8.6% m/m outdated)

Dallas Fed Manufacturing Index for November: -19.9 (-17 forecast; -19.2 outdated)

In a panel dialogue, RBA Gov. Bullock grand that they’re restful devoted to bringing down inflation however moreover watch out about “now not imposing on the economic system too highly effective and elevating the unemployment cost” too excessive

U.Ok.’s BRC store designate index confirmed inflation in U.Ok. retailers falling weakening from 5.2% y/y to 4.3% y/y in November, the bottom since June 2022

Australia’s retail gross sales for October: -0.2% m/m (0.1% m/m forecast, 0.9% outdated)

BOJ’s core CPI for October: 3.0% y/y (3.4% y/y forecast and outdated)

German GfK client local weather for November: -27.8 (-28.2 forecast, -28.Three outdated)

Tag Motion News

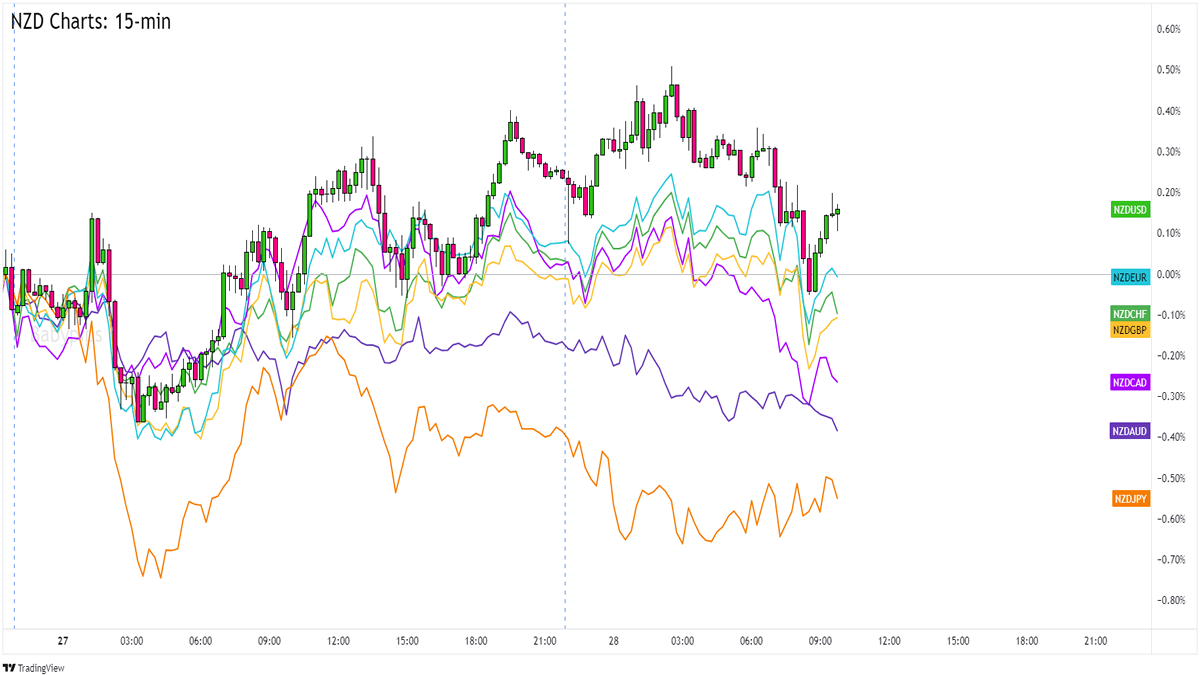

Overlay of NZD vs. Foremost Currencies Chart by TradingView

The New Zealand greenback grew to become as soon as throughout all each different time one of the vital supreme movers in Asia and early European session buying and selling, and this time it’s to the diagram again.

New Zealand didn’t print high-tier financial stories nevertheless it completely doubtlessly didn’t abet that Australia printed a weaker-than-expected retail gross sales recordsdata whereas Beijing’s inventory alternate index dropped by 4.2%, the steepest drop given that index grew to become as soon as created in November 2022.

After which there’s the upcoming Reserve Bank of New Zealand (RBNZ) decision the place the central financial establishment is anticipated to guard its insurance policies unchanged for one different month.

NZD is buying and selling the bottom towards CAD and AUD nevertheless it completely’s nearly (however now not moderately) throughout the fairway towards CHF and JPY.

Upcoming Attainable Catalysts on the Financial Calendar:

U.S. S&P dwelling designate index at 2:00 pm GMT

U.S. CB client self belief at 3:00 pm GMT

FOMC member Austan Goolsbee to current a speech at 3:00 pm GMT

FOMC member Christopher Waller to current a speech at 3:05 pm GMT

ECB President Lagarde to current a pre-recorded speech at 4:00 pm GMT

FOMC member Jonathan Haskel to current a speech at 5:00 pm GMT

FOMC member Barr to current speeches at 6:05 pm GMT and eight:30 pm GMT

Australia’s quarterly CPI at 12:30 am GMT (Nov 29)

Australia’s quarterly development work completed at 12:30 am GMT (Nov 29)

RBNZ’s protection resolution at 1:00 am GMT (Nov 29)

Exercise our new Currency Warmth Design to quickly survey a visible overview of the foreign exchange market’s designate inch! 🔥 🗺️

NZD/USD: 15-min

NZD/USD 15-min Forex Chart by TradingView

NZD/USD has been in an observable uptrend since unhurried final week after the pair bounced from the .6000 well-known psychological stage.

NZD/USD extra solely at the moment grew to was elevated from the .6080 designate, which is attractive smack on the sample line crimson meat up throughout the 15-minute timeframe. The stage could perhaps per likelihood be come the 200 SMA and the Pivot Point (.6090) line.

Can the pair lengthen its options at the moment time?

Rob communicate that the RBNZ is extra liable to guard its interest expenses unchanged for one different month. On the other hand, it’s additionally perhaps that the trek is already priced in. The RBNZ could perhaps per likelihood be publishing its quarterly problem alongside with this month’s decision, so the chances of a “hawkish stop” is…now not zero.

A buy-the-recordsdata discipline, and even trustworthy persevered USD-promoting could perhaps properly presumably diagram in ample consumers to elongate NZD/USD. If we enact survey NZD vitality and USD weak level, the .6110 outdated excessive could perhaps properly presumably entice a complete lot of short-timeframe earnings-takers as a result of it’s additionally come the R1 (.6120) Pivot Point stage.

While you occur to don’t in precise reality really feel treasure taking assist of NZD/USD’s ascending channel and 200 SMA crimson meat up bounce, then you definitely definately may consider of buying and selling the setup after the RBNZ decision.

Appropriate form perform apparent that you understand what NZD/USD’s common volatility is and that you simply apply your buying and selling perception when implementing your alternate ideas!

The post Each day Forex News and Watchlist: NZD/USD appeared first on FOREX IN WORLD.