The S&P 500 Has Been Living and Dying by the Magnificent 7

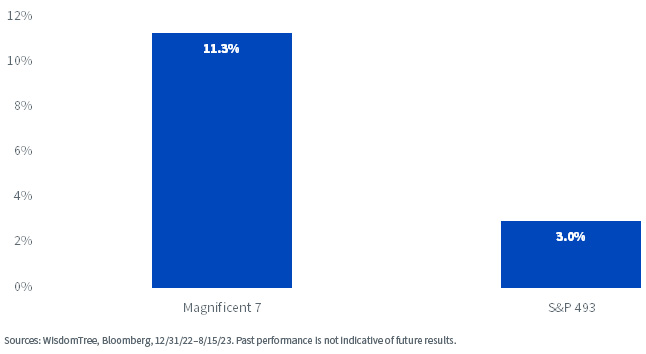

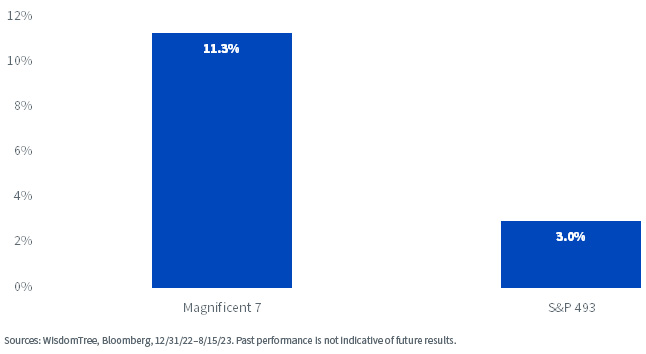

The negative performance of equity markets in 2022 was already driven mostly by tech stocks. The negative impact of increasing interest rates, slowing growth and reduced IT spending on tech stocks and, in particular, on Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla, impacted market performance. With the S&P 500 down 18.1%, those seven stocks combined contributed around -11%.1 In 2023, the concentration of returns is even more acute, at 11.3% of the 14.3%2 performance of the S&P 500.

Figure 1: Contribution of the Magnificent 7 Year-to-Date in the S&P 500

This year, the concentration was so acute that Nasdaq had to perform an exception rebalancing in July to reallocate some of the weight in the Nasdaq 100 away from these stocks.

Index Concentration: A Long Time in the Making

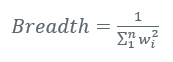

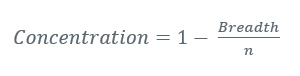

Looking at the top holdings in an index gives a good idea of its concentration. However, a more systematic way to assess this concentration across different indexes is to compare the “effective number of stocks” in the index compared to the full number of stocks in the index. The effective number of stocks quantifies how many independent stocks would provide the same level of diversification as the index and is calculated as

where

n is the number of stocks in the index

w is the weight of each stock in the index

Concentration is then derived as

Figure 2 exhibits the concentration of the S&P 500 over time since the early 90s. We note that the concentration is around its all-time high. It is also worth mentioning that the last time the concentration was this acute (a bit less acute to be fair), was in March 2000, on the eve of the dot-com crash.

In August 2023, the concentration was 87.7%, meaning that the effective number of stocks in the S&P 500 is just 61.

Figure 2: Concentration of the S&P 500 over Time

Reduce Concentration in Investors’ Portfolios—Fundamental or Thematic Weighting

This level of concentration in market cap-weighted equity indexes is worrying on many levels. But at a basic level, it means that Investors are under-diversified when investing in indexes with market cap-weighting. This could lead to a heightened level of hidden risk/volatility in a portfolio.

When it comes to dealing with this concentration, one often-mentioned solution is equal-weighted indexes. While this does, of course, address the concentration issue, we think it is not the only answer.

Fundamentally driven or thematic indexes can also reduce the concentration in a way that investors need. Figure 3 highlights the concentration and weight of the Magnificent 7 in:

- Market cap-weighted indexes: S&P 500/Russell 2000

- Fundamentally weighted large-cap indexes: WisdomTree U.S. Quality Dividend Growth Index and WisdomTree U.S. Multifactor index

- Fundamentally weighted small-cap indexes: WisdomTree U.S. Small Cap Quality Dividend Growth Index and WisdomTree U.S. MidCap Dividend Index

- WisdomTree thematic Indexes

Figure 3: Concentration and Magnificent 7 Weights in Different Indexes

Clearly, fundamentally weighted indexes exhibit reduced concentration and reduced allocation to the Magnificent 7. In the small-cap space, the concentration in the Magnificent 7 is not an issue, of course, but we still observe that fundamentally weighted indexes have lower concentration than the Russell 2000. Thematic indexes exhibit even lower concentration, leading to very powerful diversification properties.

By selecting only high profitability, dividend growing companies and weighting by cash dividend paid, the WisdomTree Quality Dividend Growth Indexes exhibit a lower concentration and smaller allocations to the Magnificent 7 compared to the S&P 500 or the Russell 2000.

Similarly, the concentration in all the thematic indexes highlighted in figure 3 is extremely low, with the BVP Nasdaq Emerging Cloud index, for example, exhibiting a concentration of 1%. Also two of the thematic indexes do not invest at all in the Magnificent 7, leading to very high differentiation.

Conclusion

Diversification offers one of the best ways to improve overall investment outcomes. Over the last decades, investors used products tracking broad equity indexes, which are typically market cap-weighted, as a tool to increase diversification in their portfolios. Unfortunately, over-concentration has rendered this tool blunter and less efficient. As an alternative, investors can turn toward other strategies such as fundamentally weighted strategies or thematic strategies to increase the diversification in their portfolios.

1 Sources: WisdomTree, Bloomberg, 12/31/21–12/31/22.

2 Sources: WisdomTree, Bloomberg, 12/31/22–9/15/23.

]]>