The post How to Start Forex Trading in Germany by Sarah Horvath appeared first on Benzinga. Visit Benzinga to get more great content like this.

German traders enjoy an enhanced level of security and liquidity when they trade forex as a member of the European Union and a native holder of the euro. If you’ve ever been curious about foreign exchange trading, Benzinga’s guide to forex trading in Germany will help you learn more and help you get started.

Table of contents

[Show]

Get Started with Forex in Germany

Getting started trading forex as a German citizen is easy. Use these simple steps to begin:

- Stabilize your internet connection: A forex trader’s most important tool is a strong and solid internet connection. Choose a device with a consistent connection before you open your brokerage account.

- Select a forex broker: When you trade forex, you don’t buy and sell currencies directly — you work through a regulated broker authorized to accept these orders on your behalf. There are many domestic and international brokers that offer access to German traders. Do a bit of research on each broker’s tools, fee schedule and services before you open an account.

- Choose your platform: Though many brokers offer their own proprietary platform, you might want to work with a larger, more widely available platform like MetaTrader 4 or 5.

- Fund your account: Once your account is open and your platform is ready to go, it’s time to fund your account. You can link your domestic bank account with your forex account and transfer money into their forex account directly. Depending on your bank and forex broker, it might take a few days for your funds to clear.

- Place your first order: As soon as your funds clear, you can place your first order following your broker’s instructions on your platform of choice.

Germany Forex Trading Strategies

You’ll find two major trading strategies that traders across Germany use to evaluate their trades and decide the right time to buy. Let’s take a look at the two major classifications of forex analysis and how you can use them to trade more effectively.

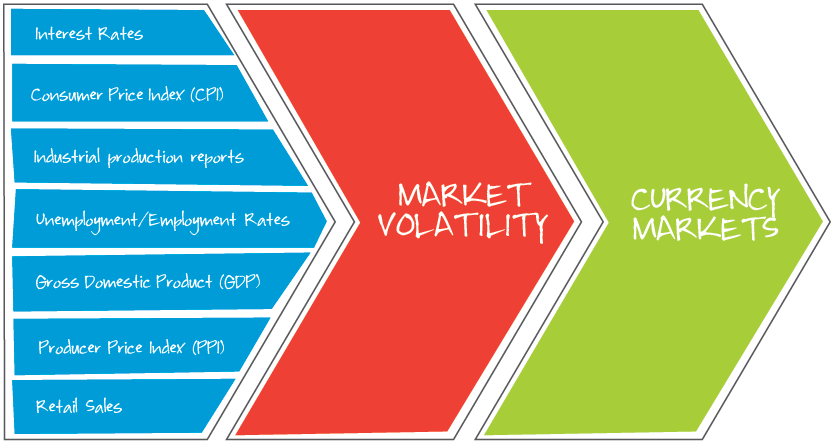

Fundamental Analysis

Traders who use fundamental analysis as their primary method of analysis evaluate each country in terms of its economic and trade strength. These traders then consider which countries are likely to see increases in their relative currency value and invest their funds in them.

Some of the reports and factors that traders who use fundamental analysis may look at include:

- Interest rates

- Unemployment rates

- Non-farm payrolls

- GDP growth

- Business sentiment

- Trade balances

- Consumer confidence indexes

Trading with fundamental analysis doesn’t require hard math skills or top-notch software, but you’ll need a solid news feed and a finger on the pulse of current events.

Technical Analysis

Unlike fundamental analysis, traders who use technical analysis to fuel their primary trading method look only at charts and price data. They use candlestick charts and patterns to predict how a currency will move in the short term based on how the currency has behaved in the past under similar conditions. Most traders who focus on technical analysis strategies don’t pay much attention to the political events or economic details of the countries whose currencies they exchange.

Some of the factors that traders who use technical analysis will look for when charting currencies may include:

- Resistance and support levels

- Reversal signals tell the trader that a price trend will change

- Breakout points where a currency moves above or below an established resistance or support level

A solid charting platform and instant, real-time currency data are both must-haves when trading using technical analysis.

Forex Trading Example in Germany

Let’s take a look at an example of how forex trading might work as a trader in Germany.

You believe that the U.S. dollar is soon going to rise in relation to the value of the euro, so you decide to invest some of your native EUR into USD. You transfer 10,000 EUR into your forex broker account, and your forex broker offers you 10:1 leverage when buying and selling USD. This means that you can trade with the power of 100,000 EUR despite only having 10,000 EUR in your account.

After accounting for your broker’s spread, you see that 1 EUR is currently equal to 1.11 USD. Using your leverage, you invest 100,000 EUR into USD and receive 111,000 USD.

Soon, the value of the USD rises. When you decide to sell, 1 EUR is now worth only 1.09 USD. You convert your entire lot of USD back to EUR and receive 101,835 EUR. After you return what you borrowed in leverage, you take away a total profit of 1,835 EUR.

Making Money with Forex in Germany

German traders make up a large percentage of the world’s foreign exchange trading sphere. It’s very possible to make money trading forex in Germany and German traders enjoy a number of advantages over other countries, including:

Strong Native Currency

The native currency of Germany is the euro. The euro is 2nd only to the U.S. dollar in terms of worldwide reserves. The euro made up about 19% of the world’s reserves in late 2018, meaning that it’s a relatively stable and safe currency to hold. German traders run into fewer issues with liquidity and currency order executions when compared to traders who hold non-reserve currencies as their base currency.

Robust Central Banking System

Germany enjoys one of the world’s strongest central bank systems. This means that you’ll be able to quickly move money between accounts without the layers of authorization commonplace in some foreign countries. Forex Germany facilitates forex transactions that depend on the stability of the central bank.

Access to Multiple Layers of Regulation and Protection

German traders are protected by both Germany’s native Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht or “BaFin”) as well as the European Union’s European Securities and Markets Authority (ESMA). Both the BaFin and the ESMA work together to prevent forex scams and fraud, which makes Germany an exceptionally safe country to open a brokerage account in.

If you do decide to begin trading forex, remember that it’s up to you to report and document all of the profits you earn. Forex earnings are subject to taxation in Germany, which means that you may land in legal hot water if you fail to report all of your earnings.

Best Online Forex Brokers in Germany

There are many domestic and international brokers offering German traders access to the forex market. The amount of leverage, the spreads you’ll pay, and the currency pair you’ll be able to buy and sell will all vary depending on the forex broker you choose to work with.

You’ll also find that different forex brokers offer different types of trade platform options within the currency market such as copy trading or CFD trading.

If you aren’t sure which broker is right for you, consider a few of our top picks for forex trading broker in the table below.

HYCM is 1 of the world’s leading forex brokers, offering investors access to over 69 unique currency pairs. However, forex isn’t the only thing the broker offers — HYCM also offers high rates of leverage, stock and ETF trading, commodity investing and much more. Getting started with HYCM is quick and easy, and most investors can open an account in as little as 10 minutes.

HYCM offers a varying fee structure, which allows investors to choose the spread option that’s best for them. A wide range of educational and investing tools are available, which can be equally beneficial to both experienced and novice traders. Though HYCM isn’t currently available in the United States, it can be a great choice for residents of the other 140 countries where it offers service.

Best For

- Investors who want a customizable fee schedule

- Traders comfortable using the MetaTrader platform

- Islamic traders who need swap-free accounts that don’t build interest

- Mobile app with a simple trading experience

- Wide range of currency pairs available

- Excellent selection of educational tools

- Not currently available to traders based in the U.S.

FOREX.com is a one-stop shop for forex traders. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX.com is an excellent choice for brokers searching for a home base for their currency trading. New traders and seasoned veterans alike will love FOREX.com’s extensive education and research center that provides free, informative forex trading courses at multiple skill levels. While FOREX.com is impressive, remember that it isn’t a standard broker.

Best For

- Beginner forex traders

- Active forex traders

- Impressive, easy-to-navigate platform

- Wide range of education and research tools

- Access to over 80 currencies to buy and sell

- Leverage available up to 50:1

- Cannot buy and sell other securities (like stocks and bonds)

A fully regulated broker with a presence in Europe, South Africa, the Middle East, British Virgin Islands, Australia and Japan, Avatrade deals with mainly forex and CFDs on stocks, commodities, indexes, forex, cryptocurrencies, etc. This brokerage is headquartered in Dublin, Ireland and began offering its services in 2006. It offers multiple trading platforms and earns mainly through spreads.

Best For

- Beginners

- Advanced traders

- Traders looking for a well-diversified portfolio

- Controlled by regulatory agencies of multiple countries

- Choice offered in terms of trading platforms

- Support available in 14 languages and trading platforms in 20 languages

- Practice/demo account available for trying out

- Breadth of trading assets

- Does not accept customers from the U.S. as it isn’t regulated in the U.S.

- Transferring funds to the account may take up to five days; withdrawals could take up to 10 days

Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. U.S. traders can begin buying and selling both major cryptocurrencies (like Bitcoin and Ethereum) as well as smaller names (like Tron Coin and Stellar Lumens).

eToro offers traders the opportunity to invest their assets into premade portfolios or cryptocurrencies, similar to services offered by robo-advisors through traditional brokers. Though eToro isn’t a one-stop-shop for everything an investor needs, its easy-to-use platform and low spreads is a great way to enter the cryptocurrency market.

Best For

- International Forex/CFD Traders

- New cryptocurrency traders looking for an easy-to-use platform

- Traders who want to buy and sell cryptocurrencies on-the-go

- Simple platform that is easy to master

- CopyTrader feature that allows new traders to copy the same strategies used by professionals

- Virtual dummy account that gives you $100,000 to practice trades

- U.S. traders currently limited to cryptocurrencies

- Only 15 major coins available to trade

Forex Terminology

The realm of forex trading is unique because its traders and brokers have their own language they use to talk about trading and currency movements. Before you begin trading, familiarize yourself with some of the most common forex trading terms below.

- Pip: A pip is the smallest possible unit of any given currency, usually 0.0001 of any one unit. The term “pip” is used to quantify currency movements. For example, if the value of the USD in relation to the EUR moves from 0.8901 to 0.8902, it means the price moved by a single pip.

- Lot size: Your lot size is the total number of units of currency that you buy or sell. For example, if you decide to exchange 10,000 euros for USD, your lot size is 10,000. Most forex brokers and traders consider 100,000 units of currency to be the standard lot size.

- Orders: An order is a set of instructions you provide to your broker with regard to which currencies you want to buy or sell. There are many different types of orders that you can use to ensure that your purchase or sale is executed at the exact terms you need.

- Call: If your total account equity falls below a certain percentage when using leverage, your broker may subject you to a margin call. During a margin call, you’ll be required to deposit additional funds into your account if your total equity falls below a certain percentage. Margin calls are 1 of the many risks of using leverage.

Mastering the Foreign Exchange Market

Unlike many other parts of the world, the European Union has placed limitations on the amount of leverage forex brokers may offer clients. While you may still access up to 30:1 leverage when trading major currency pairs, you need to carefully manage your risk and only use an amount of leverage appropriate for your skill level. Even using a small amount of leverage can cause you to lose money, so take some time to perfect your trading strategy before you borrow.

Is trading forex in Germany legal?

Yes, trading forex in Germany is legal.

Is trading forex in Germany safe?

Forex trading in Germany is goverened by the EU and that makes it safe to trade forex in Germany with a liscensed broker.

Where can I find a liscensed forex broker in Germany?

You can find a liscensed forex broker in Germany by looking at the above list.

The post How to Start Forex Trading in Germany by Sarah Horvath appeared first on Benzinga. Visit Benzinga to get more great content like this.