The concept of carry trading vanished in the aftermath of the 2008 global financial crisis. As the world faces yet another financial crisis, this time caused by rapid inflation, the elusive carry trade has resurfaced.

It’s unclear how long carry trading opportunities will be around, so here’s your guide to carry trading in 2023. This article explores the lost art of carry trading, a unique currency trading strategy that capitalises on interest rate spreads rather than speculating on exchange rates.

What is carry trading?

Carry trading is a simple but risky forex trading strategy. Carry trading is a strategy where traders profit from interest rate spreads rather than buying and selling at better exchange rates.

Consider someone who lives in Sweden with 200,000 SEK (approximately US$19,200) in savings. In November 2022, Sweden’s central bank, Sveriges Riksbank, raised its repo rate to 2.5%. However, the average retail savings account would pay less than 1% interest on deposits. With 200,000 SEK deposited in a savings account, the depositor would only earn 2,009.2 SEK (approximately US$193) in one year.

Alternatively, they could deposit their savings in a Hungarian bank, where the Hungarian National Bank has set interest rates at 13%. To do so, they would need to convert their Swedish krona to Hungarian forint, exposing them to long-term currency exchange risks.

Instead of opening bank accounts in different countries and converting life savings to different currencies, investors and traders can use derivatives to perform carry trading strategies to take advantage of high interest rates in other countries.

Carry trading with derivatives

Unlike other derivatives, such as futures or options, contracts-for-difference (CFDs) do not expire. CFDs can essentially be held indefinitely and closed anytime, making them incredibly flexible trading instruments. However, when traders hold positions with a CFD broker overnight, they are rolled from one day to the next using a tom-next trade. Tom-next trades happen behind the scenes, but traders’ positions are adjusted using swaps.

Swap rates are based on the interest rate spread of the currencies you’re borrowing, and the tom-next rates used to roll a position over. Depending on the interest rate spreads, swaps may be very high or low and positive or negative. Except for some exotic and volatile currency pairs, positive carries were a rare occurrence until recently.

What is a positive carry?

Swaps are the interest rate differential between currencies in a currency pair. If swaps are positive, you earn interest; if they are negative, you pay interest. At the end of each trading day, at 17:00 New York time, brokers carry all their customers’ open positions to the next day, running a procedure called a rollover; this is when brokers collect or pay swaps.

A positive carry is when a trader holds a position in a particular currency primarily to profit from the positive swap payments. The trader will typically carry the position until the interest rate differential between the two currencies narrows or expects the exchange rate to change. When the trader exits the position, they will typically profit from the positive swap payments. For the trade to be successful, the swaps earnt should cover any losses from exchange rate changes.

Leverage and carry trading

Using leverage, investors and currency traders can open large positions to benefit from positive swap payments. For example, with 1:20 leverage on Swiss franc vs Hungarian forints, traders can open a 100,000 CHF/HUF position with 5,000 Swiss francs.

Moreover, traders don’t even need to buy Swiss francs to open a CHF/HUF position as trading accounts can be funded in various currencies, such as the Swedish korona. Forex trading platforms will calculate the margin required in the account currency based on the notional value of the contract and the available leverage.

Therefore, with 1:20 leverage, a trader can open a position for 100,000 CHF/HUF with approximately 56,000 SEK.

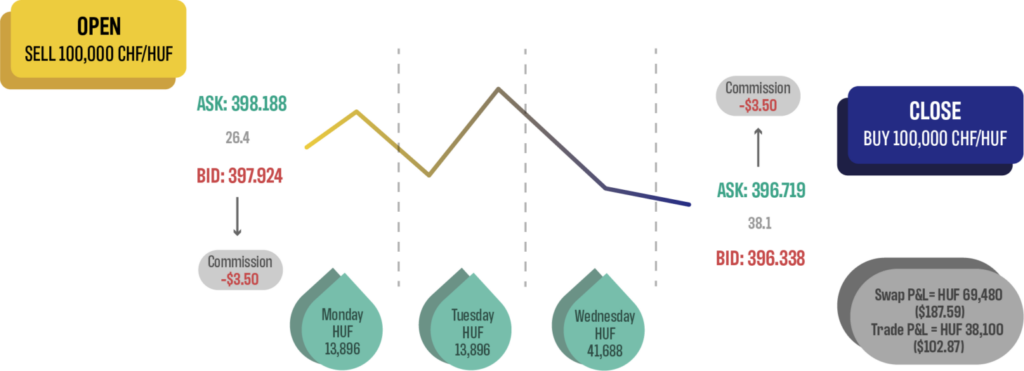

Carry trade example

Suppose the short swap rate for CHF/HUF is 15 pips. If a trader opens a short position of 100,000 CHF/HUF, the pip value is 1,000 HUF. Therefore, the trader will earn 15,000 HUF (approximately US$40) in swaps every night. If the position is carried from Wednesday to Thursday, it will receive a triple rollover payment.

It’s important to note that swap rates vary according to whether the position is long or short. If a short swap rate is positive, the long swap rate is likely negative. In the example of a long CHF/HUF position, the long swap rate could be -25 pips, meaning an overnight swap charge is 25,000 HUF (approximately US$68).

Suppose a trader holds a short 100,000 CHF/HUF position from the 1st of December to the 30th of December 2022, and the short swap rate is 15 pips; the position would accumulate 450,000 HUF in swaps (approximately US$1,230).

In addition to the positive swap payments, carry traders need to consider currency exchange fluctuations. On the 1st of December, the CHF/HUF opened at 415.66 and closed at 403.871 on the 30th of December. In this case, the short position would have gained 1,790 pips, which is 1,178,900 HUF (approximately US$3,220).

While everything in this example worked out in the traders’ favour, that’s not always the case.

Carry trading risks

The main risk associated with forex carry trading is exchange rate risk. If the exchange rate changes significantly between the time the position is opened and the time the position is closed, the trader could potentially incur a significant loss. For carry trading strategies to be as effective as possible, traders must ensure that profits from positive swap payments exceed any losses from exchange rate differences.

There is also an interest rate risk. If the interest rates of the two currencies change and the positive swap becomes negative, the trader could incur a loss. While traders can use stop losses to prevent uncontrolled losses, they must pay attention to central bank interest rate decisions.

The history of carry trading

During the ‘80s, ‘90s and early noughts, currency traders profited by earning overnight interest on their positions, which they would hold for several months or longer. This generation’s forex traders probably only know of carry trading from the history books.

The Japanese yen has always been a favourite currency for carry trading as the Bank of Japan has kept interest rates at or below zero for decades. Other currencies with higher yielding interest rates and complemented the Japanese yen were the Australian dollar or New Zealand dollar due to their relative stability.

When banks slashed interest rates to treat the 2008 financial crisis, they destroyed carry trading. With rising interest rates to tackle global inflation, the elusive carry trade is better than ever.

Best currency pairs for carry trading

The table below shows currencies with low and high interest rates. The best currency pairs for carry trading are those with the widest interest rate differential, which results in higher positive swap rates. Finding a currency pair that combines a currency with a high and low interest rate should offer an opportunity to yield positive swap payments when holding a position overnight.

| Currency | Interest rate | Currency | Interest rate |

|---|---|---|---|

| Hungarian forint (HUF) | 13% | Japanese yen (JPY) | -0.1% |

| Mexican peso (MXN) | 10.5% | Swiss franc (CHF) | 1% |

| Turkish lira (TRY) | 9% | Danish krone (DKK) | 1.75% |

| Czech koruna (CZK) | 7% | Euro (EUR) | 2.5% |

| South African rand (SAR) | 7.25% | Swedish krona (SEK) | 2.5% |

| Polish zloty (PLN) | 6.75% | Norwegian krona (NOK) | 2.75% |

| United States dollar | 4.5% |

To take advantage of carry trading opportunities, you need to identify the currency pairs offering a positive swap. In addition, it’s crucial to find pairs with low volatility to reduce exchange rate risk or choose pairs with high enough positive swaps to offset the risk.

| Currency pair | 4-week volatility | Pip value/lot | Long swap | Short swap |

|---|---|---|---|---|

| CHF/HUF | 13.6 | 1,000 HUF | -22.829 | 13.976 |

| EUR/HUF | 11.3 | 1,000 HUF | -21.181 | 12.998 |

| USD/HUF | 15.3 | 1,000 HUF | -16.607 | 10.078 |

| EUR/CZK | 3.9 | 100 CZK | -5.058 | 1.996 |

| USD/CZK | 10.7 | 100 CZK | -26.059 | 5.488 |

| CHF/PLN | 10.3 | 100 PLN | -1.064 | 0.553 |

| EUR/PLN | 3.5 | 10 PLN | -8.592 | 4.279 |

| EUR/MXN | 13.1 | 10 MXN | -68.323 | 28.048 |

| USD/MXN | 8.7 | 10 MXN | -47.4 | 16.156 |

| EUR/TRY | 10 | 10 TRY | -117.425 | 50.645 |

| USD/TRY | 3.3 | 10 TRY | -92.363 | 52.057 |

| USD/JPY | 15 | 1,000 JPY | 1.119 | -2.549 |

How to check swap rates

You can check the current swap rates on the cTrader and MetaTrader 4 platforms. In cTrader, you can find swap rates for each symbol in the active symbol panel. In MT4, you can find the swap rates by right-clicking on any symbol in the market watch and selecting “Specification”. MetaTrader 4 shows swap rates in points, and cTrader shows them in pips.

How to start carry trading

Most forex brokers operate dealing desks, where they offset customers’ orders internally. While dealing desk brokers can be more competitive on spreads for major currency pairs but cannot compete with STP brokers on exotic currency pairs or swap rates. Dealing desk brokers don’t execute your positions with liquidity providers and therefore don’t earn swaps on your behalf. To begin your carry trading strategy, you need an STP broker like Scandinavian Markets to access the forex market.

The post Introduction to Forex Carry Trading appeared first on Scandinavian Capital Markets.