The Bank of Canada (BOC) is up in just a few days!

Discover all around the block is that the central financial institution will likely withhold its ardour payment accurate in September.

What’s up with that and the scheme in which would possibly perchance also CAD traders react?

Listed below are functions you would possibly even absorb to know whereas you happen to’re planning on buying and selling the central financial institution tournament:

Match in Focal point:

Bank of Canada (BOC) Monetary Policy Assertion

When Will it Be Launched:

September 6, 2023 (Wednesday): 2:00 pm GMT

Utilize our Forex Market Hours tool to convert GMT to your native time zone.

Expectations:

- BOC to deal with its main policy ardour payment at 5.00%

- Policymakers to reiterate that they’re calm arresting to hike if records requires it

Connected Canadian Files For the rationale that Closing BOC Assertion:

🟢 Arguments for Hawkish Monetary Policy / Bullish CAD

S&P World Canada Manufacturing PMI for July: 49.6 vs. forty eight.8 June

Raw materials prices index for July: 3.5% m/m (0.2% m/m forecast; -2.0% m/m old); Industrial product tag index used to be 0.4% m/m (0.0% m/m forecast; -0.6% m/m old)

CPI for July: 0.6% m/m (0.4% m/m forecast; 0.1% m/m old); core CPI used to be 0.5% m/m (0.5% m/m forecast; -0.1% m/m old)

Ivey PMI Costs Index for July used to be at 65.1 vs. 60.6 old

S&P World Canada PMI seek: moderate enter prices rose and the payment of inflation accelerated to a four month excessive.

Building Permits for June: 6.1% m/m (-1.3% m/m forecast; 12.6% m/m old)

Retail Sales for June: +0.1% m/m to C$65.9B (-0.1% forecast; 0.1% m/m old)

🔴 Arguments for Dovish Monetary Policy / Bearish CAD

Employment Switch for July: -6.4k (20.0k forecast; 59.9k old); unemployment payment: 5.5% vs. 5.4% forecast/old

Ivey Manufacturing PMI for July: forty eight.6 vs. 50.2 old; Employment Index at 54.2 vs. 57.6 old;

Housing Starts for July fell -10% y/y to 255.0k (243.0k forecast; 283.5k old)

New Housing Effect Index for July: -0.1% m/m (0.0% m/m forecast; 0.1% m/m old)

June month-to-month GDP declined 0.2% from Can also; Q2 GDP without warning shriveled by 0.2% (vs. 1.2% anticipated)

S&P Canada Manufacturing PMI for August: forty eight.0 vs. 49.6 in July

Old Releases and Risk Atmosphere Influence on CAD

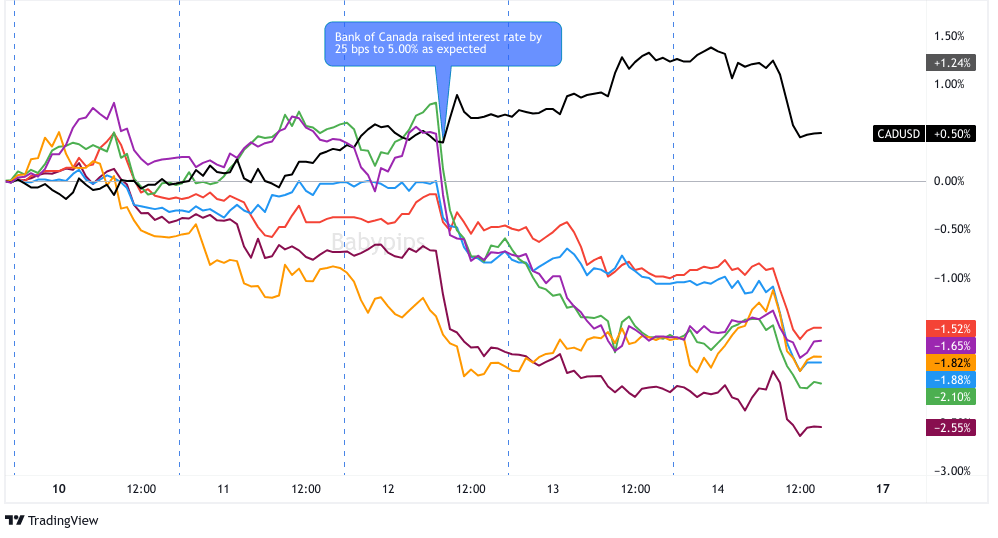

July 12, 2023

Overlay of CAD vs. Main Currencies Chart by TV Chart by TV

Action/outcomes: As anticipated, the BOC raised its ardour charges by one other 25bps to 5.00%. BOC Gov. Tiff Macklem additionally shared that “inflationary pressures are proving more power than we anticipated” nonetheless that he and his crew will be taking every future payment announcement “one after the other.”

The possibility of fixing into records-dependent in their future policy choices didn’t sit down effectively with these who anticipated more payment hikes. Right here’s doubtlessly why CAD dropped all around the board at the guidelines and started intraweek downtrends that didn’t let up unless the week ended.

Risk atmosphere and Intermarket behaviors: Consolidation used to be the establish of the game that week. However, downbeat U.S. CPI figures made for an anti-USD buying and selling atmosphere whereas old Chinese commerce records raised speculations for a PBOC stimulus.

Right here’s doubtlessly why “risk” resources be pleased commodity-linked currencies (with the exception of CAD) won ground whereas safe-haven that which you would possibly well be ready to deem of choices be pleased CHF and JPY saw intraweek gains.

June 7, 2023

Overlay of CAD vs. Main Currencies Chart by TV Chart by TV

Action/outcomes: After preserving its ardour charges accurate in the March and April meetings, the BOC stunned markets with its first payment hike since January. The central financial institution raised its main ardour charges by 25 foundation functions to 4.75% as a substitute of pausing at 4.50% as markets had anticipated.

In its statement, BOC members important their concerns that prime inflation “would possibly perchance well secure stuck materially above the 2% target” as effectively as their belief that their old policies weren’t “sufficiently restrictive” lawful but.

The shock (and hawkish!) payment hike, which came a day after the RBA finished its own payment hike, boosted the Canadian buck sharply in the center of the U.S. session and ended the day no longer removed from its intraday highs.

Risk atmosphere and Intermarket behaviors: The open of weaker-than-anticipated ISM services and products PMI in the U.S. and disappointing commerce records from China made it tricky to withhold risk rallies all around the week.

“Unstable” bets be pleased crude oil, AUD, and CAD popped greater on specific headlines be pleased stronger oil ask records and the RBA and BOC’s hawkish payment hikes. Even then, the resources soon lost ground and fell in step with the total risk-averse buying and selling atmosphere.

Effect action prospects

Risk sentiment prospects: Files from the U.S. and other main economies are coming in most spicy a exiguous of weaker to expectations, presumably encouraging investors all around the field to explore decreased dangers of additional ardour payment hikes by main central banks and raising the percentages of a “refined landing.”

At the present, there doesn’t seem to be a solid risk bias given the vacation in North The US and a somewhat gentle calendar ahead, so except take the second and third tier economic updates this week as arguments to focus more on global enhance concerns rather then “height ardour payment” speculations, we can also secure out about persevered risk-taking in the markets.

Also, absorb in mind that Wall Avenue is coming support from the Summer season season, so volatility and directional energy can also fetch relative to the past few months as the week progresses.

Canadian Dollar scenarios

Putrid case: Canada’s inflation remains elevated at 3.3% y/y in July. However, markers equivalent to housing and labor market counsel weaknesses that would possibly perchance well be welcome to the BOC.

Right here’s why the BOC will likely withhold its ardour charges at 5.0% this week. The truth is, many analysts ask no changes from the central financial institution no lower than unless early 2024. And be pleased the opposite main central banks, Governor Macklem and his crew will additionally absorb to deal with additional payment hikes on the desk to deal with traders from pricing in ardour payment cuts upfront.

Price hike pauses in March and in April were anticipated, nonetheless that didn’t end CAD bears from attacking support then. So, CAD must always calm secure hit with some promoting even supposing a payment hike cease materializes.

In case of a payment hike cease and without hawkish rhetoric from the BOC, CAD can also secure out about losses in opposition to safe havens be pleased CHF and JPY as effectively as fellow commodity currencies be pleased AUD and NZD.

Different Scenario: If the BOC surprises with one other ardour payment hike (a possibility given the upside inflation surprises in both onerous and refined records), that shock ingredient will presumably bump the Loonie greater all around the board.

On this scenario, secure out about for CAD to doubtlessly secure out about non everlasting gains in opposition to JPY and CHF, in particular if risk-on sentiment. And, if the markets continues its shift a exiguous of in the direction of anti-USD sentiment, USD/CAD can also secure out about additional losses at the dedication.

The post Match Manual: BOC Monetary Policy Assertion September 2023 appeared first on FOREX IN WORLD.