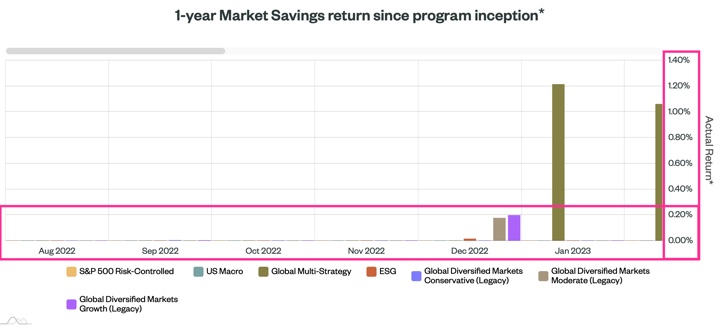

Update February 2024: It’s nice to see that Save now provides a link to their actual returns for their 1-year Market Savings across all portfolios. But be careful, as much of what is shown at first glance is for products that haven’t actually completed their entire terms. You need to scroll all the way left to find numbers for products that have reached maturity and actual paid out any returns. For example, starting December 2022 and ending December 2023, or January 2023 through January 2024. Screenshot taken 2/29/24.

Update January 2024: I have updated this review with my final return numbers, along with additional details from my bank and brokerage statements. I hope it can help prospective users make a more educated decision.

Detailed, full review:

The Save app advertises a Market Savings Account that “combines the security of FDIC-insured bank deposits with the upside potential of market returns”. I took a glance at the advertised yields (see below) and quickly filed it under “probably too good to be true”, but still came back and took a shot due to the “free” 6X leverage offered where I could invest $1,000 and get the returns of $6,000 worth of investments.

Here is a screenshot of their advertised rates, taken 2/29/24:

A short theoretical story. Let’s say you have $1,000 and put it into a 1-year CD at an FDIC-insured bank that pays 5% APY. At the end of the year, you’d have $1,050 guaranteed. Now, imagine you went to Vegas and instead bet that $50 interest on red at the roulette table. Worst-case, you’d lose the $50 and still have $1,000. Best-case, you’d double the $50 and end up with $1,100. A 10% annual return! Now, you might charge a fee to others for this “service”. Nothing if they lose, but a little cut if they win. So $1,000 worst-case, and $1,096 if they win ($4 fee for the service).

This gives you a basic idea of what I imagined was going on here, except replace Vegas with some fancy derivatives to give you market exposure to a portfolio of stocks and bonds.

The longer Save version. Here it is, straight from Save:

Every Save® account is connected with a FDIC-insured bank account. Your deposits are never at risk. We only invest the interest on your deposits, so no matter what happens with the ups and downs of the markets, your initial deposit is never at risk for investment loss.

This app is a combination of an FDIC-insured bank account, an SIPC-insured brokerage account, and an SEC-registered investment advisor. Your money is placed into an FDIC-insured account at Webster Bank that doesn’t earn any interest. Instead of paying you interest, they will buy a portfolio of securities that offer exposure to market products like stocks and bonds. These securities are held in a brokerage account with Apex Clearing, the same firm used by brokers like Robinhood, WeBull, etc. As your financial advisor, they will charge you a fee of 0.35% annually for this service. Ex. 0.35% of $1,000 is $3.50 a year. 0.35% of $10,000 is $35 a year.

This is all taken from Save’s official documents: press release, terms and conditions, SEC Form ADV, deposit agreement, and Form CRS.

Upon opening Market Savings and initiating a deposit to the Deposit Account, Save will, on behalf of you:

– deposit your funds in full into the Deposit Account provided by Webster, member FDIC and,

– purchase a strategy–linked security selected based on your risk tolerances within a Client Account

The Market Savings Product is comprised of a Deposit Account with Webster Bank, N.A. and a Client Account with Apex Clearing Corporation.

SAVE Advisers is an investment adviser registered with the SEC. SAVE Advisers provides its clients with combined banking products and wealth management services through a web-based algorithmically driven wrap-fee investment advisory program (the “SAVE Market Savings Wrap Program”).

The SAVE Market Savings Wrap Program is designed for investors with a cash savings investment profile. The investment objective of the SAVE Market Savings Wrap Program is to enhance our clients’ cash savings investment profile by providing attractive returns on capital using Save’s core investment philosophy while preserving their initial investment.

On the Market Savings Wrap Program, Clients will pay a wrap fee at a rate of 35 basis points (0.35%) per annum (one basis point is 1/100 of 1%) on either 1.) the total notional amount of each strategy–linked security or 2.) the total notional value of the Client Deposit Account (whichever is greater).

Save products are intended for conservative investors who are mostly concerned about the protection of their principal investments.

This reminds me of the No Risk Portfolio with 100% Money Back Guarantee. Your market-linked investment may go up 10%, 100%, or whatever, but the worst thing that can happen is it goes to zero (and you still get back your initial investment). According to this WSJ article (paywall), the CEO says the chance of a zero return in any given year is about 15%. This suggests that they are using some sort of leverage. (They also say the returns will count as long-term capital gains, unlike ordinary bank interest.)

The investments in Save portfolios are held for over a year so they are taxed as long-term capital gains.

This reminds me of the structured investments and “equity-linked returns with no downside” offered by many insurance companies. The insurance companies have much more onerous early withdrawal penalties where you can lose more than your initial principal, so this seems like a much lower cost option (even if still not what I want for my primary portfolio).

Where do they get those high advertised returns? Those are back-tested numbers:

Average annual returns are based on hypothetical back-tested performance by Save of the Save Moderate Portfolio from 2006 to present.

What happens if I try to withdraw my investment before the end of my term? There is a early withdrawal fee (a slightly complicated formula), but you’ll always at least get back your initial principal.

I understand that if I terminate my account prior to the completion of an investment term I may forgo all gains and receive back only my initial deposit.

Update: My final results from December 2022 to December 2023. I deposited $1,000 in December 2022, and ended up with… $1,000 in December 2023. I got back my initial $1,000 and that was it. All of the other investments apparently matured at a value of zero. This is despite having been told that I had positive returns in the middle of my term.

Save did put my initial amount in an FDIC-insured bank account and just kept it there – nice and safe – doing absolutely nothing. No interest was earned. Each month, I got a bank statement and a brokerage statement. Here is a screenshot of my final bank statement showing $1,000 being sent back to me at the end of December 2023, after 12 months.

Below is a screenshot from my Save Brokerage statement, which was indeed held at Apex Clearing (a popular clearing firm for many fintechs, used by Robinhood, etc). Inside, they bought some sort of non-transparent, thinly-traded securities that were classified as corporate bonds. Perhaps someone with more advanced market knowledge can tell me more about these things. Example CUSIPs were 05600HTU9 and 05600H2F1.

Here is a tiny of bit info from FINRA:

The value of this security varied wildly through the year, from zero to $1 and all the way back to apparently zero?

How much of this security did they buy? In my case, it was about $15 worth per $1,000 invested. In comparison, earning 4% APY from a 1-year $1,000 traditional bank CD would equal $40.

I did sign up using a referral link and deposited $1,000 to qualify for the bonus $5,000 (at the time, lower now) for a total equivalent balance of $6,000. I thought this would be a good value bet, effectively leveraging any returns. Unfortunately, zero times anything is still… zero. I just got back my $1,000.

Now, I knew that a zero return was possible. However, the portfolio strategy that I picked is shown below. I might have accepted this return if the markets they were supposedly tracking struggled during this time period. However, nearly every major asset classes had solid positive returns for 2023. This didn’t make sense to me, so I will not be investing anything further.

Bottom line. The Save app advertises to folks “higher returns on their savings without the risks of the stock market.” They do appear to keep your principal safe in an FDIC-insured account, so indeed you can’t technically lose money. But it is unclear to me how they invest the rest. Despite their advertised 1-year return numbers, my personal experience was zero return (0.00%) on my 1-year term Market Savings investment that ran from December 2022 to December 2023. This matches their published actual returns for all investors. I did receive my initial principal back as promised.

“The editorial content here is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are the author’s alone. This email may contain links through which we are compensated when you click on or are approved for offers.”

Save App Review: 9.07% APY Advertised vs. 0.00% APY Experienced (Historical Results Now Posted) from My Money Blog.

Copyright © 2004-2022 MyMoneyBlog.com. All Rights Reserved. Do not re-syndicate without permission.