So you want to learn all about options, but you’re worried about getting confused or overwhelmed? We’ve got you covered.

You might have heard that options trading is a great way to make additional income if you’re working a full time job. Or perhaps you’re looking to enhance the returns of your investment account.

But the problem is that you just find options trading confusing and mysterious and don’t really know how to get started.

Well the reality is that options are really easy to understand. All you need to do is take a few minutes to learn some simple concepts and then a whole new world of trading will open up to you that you probably never knew existed. It’s a world where you don’t even need to pick the direction you think a stock is headed to make money on the options of that stock.

And we should know, we’re one of the top proprietary trading firms in the world, and the 50+ professional traders on our trade desk here in New York City use the strategies that we’ll be teaching you in this article all of the time. So don’t worry, we can break this down for you. It’s not that hard.

Now in this article, you’ll be hearing a lot about two key terms that are at the core of options trading: Call Options and Put Options. And while options are traded on lots of different kinds of assets, in this article we’re going to be focusing on what is meant by call and put options on stocks and call and put options on indexes.

Call Options On Stocks

So what is a call option on a stock exactly? A call option is basically a bet. The buyer of the call option is making a bet that the stock is going to go up beyond a certain price which is known as the “strike price” of that option. For that bet he pays what is called a “premium” equal to 100 times the price of the option. The call seller is the one taking that bet and receiving that premium.

If the call buyer is right, he is entitled to buy 100 shares of the stock at the strike price of the option, even if the stock has moved much higher than that price. If the call buyer is wrong, the call seller pockets the premium that the buyer paid him for taking that bet.

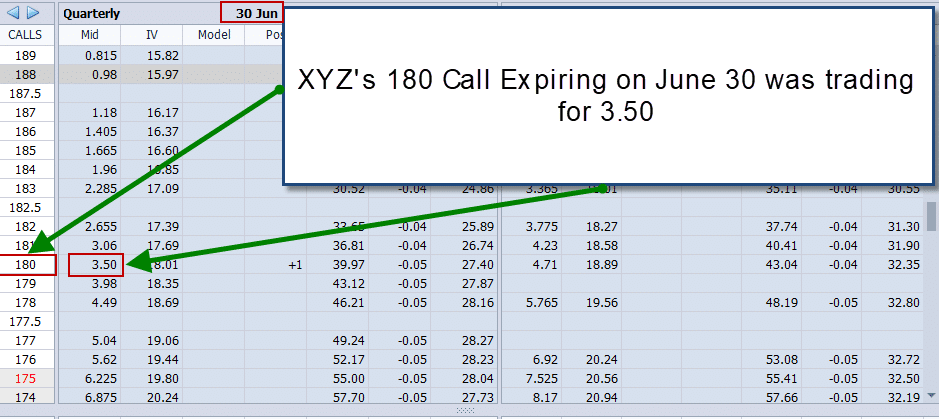

So for example, let’s say that on May 1st, XYZ stock is trading at a price of $175. Now, let’s say that a trader believes that XYZ stock will rally. Consistent with his opinion, he might decide to buy the 180 call which expires on June 30th, about two months later.

Now, options are available in what are known as “options chains” that expire on different dates in the future. So in order to buy the 180 call for XYZ stock expiring on June 30th, he goes into the section of his broker’s trading software where he can find XYZ stock options and he pulls up the June 30th chain. And as you can see, he found that on that day, the 180 call was trading for $3.50:

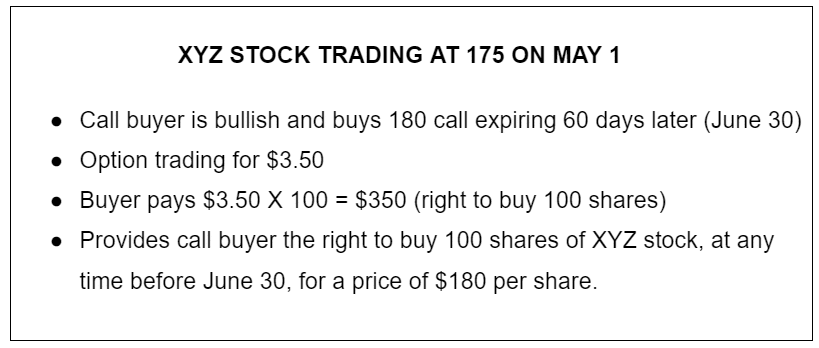

The premium for that call is $3.50 but remember he pays 100 times that price, or $350 for the right to buy 100 shares of that stock at 180 regardless of how high it goes.

If the stock rallies to say, 190, then he can exercise his call option, buy the shares for 180 and then turn around and sell them immediately for the market price of $190, making ten dollars on each of his 100 shares for a gain of $1,000 on those shares. Deducting the $350 cost of the option nets the call buyer a profit of $650. So the call buyer risked $350 to make $650, a reward that is a little less than twice the risk.

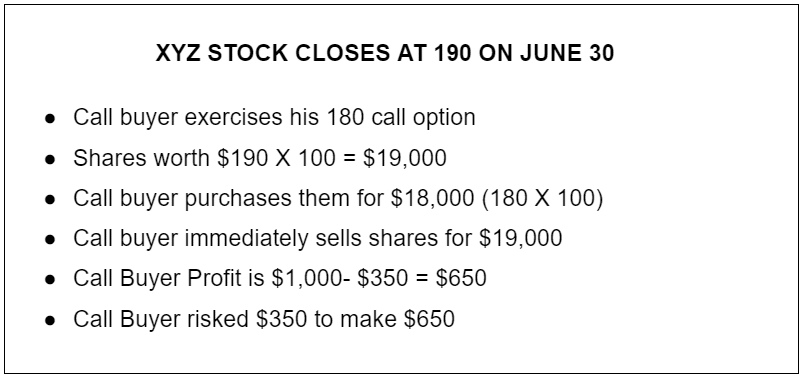

On the other hand if the stock sells off to say 160, then on November 16th, the options seller, the one who took the risk, gets to simply pocket the $350 premium he received for the call buyer’s bet. In other words, that option expires worthless.

Why is it worthless? Well if you have an option to buy shares at 180 but the stock is trading for 160, who is going to exercise that option to pay $20 more than anyone else has to pay for the same shares? No one, obviously, and so the option has no value and the option price closes at zero on the option’s expiration day.

Put Options On Stocks

Now a put option on a stock is basically the opposite bet. The buyer of the put option pays a premium in this case (again, equal to 100 times the price of the option) to the put seller, making a bet that the stock will go down beyond the strike price of the put option. And again, the put seller is the one taking that bet.

In the case of a put, if the put buyer is right, he gets to sell, to the put seller, 100 shares of a stock at the strike price of the put option, even if the stock has moved much lower than that price. If the put buyer is wrong, and the put expires ABOVE the strike price of the put option, the call seller just pockets the premium that the buyer paid him for taking that bet, as profit.

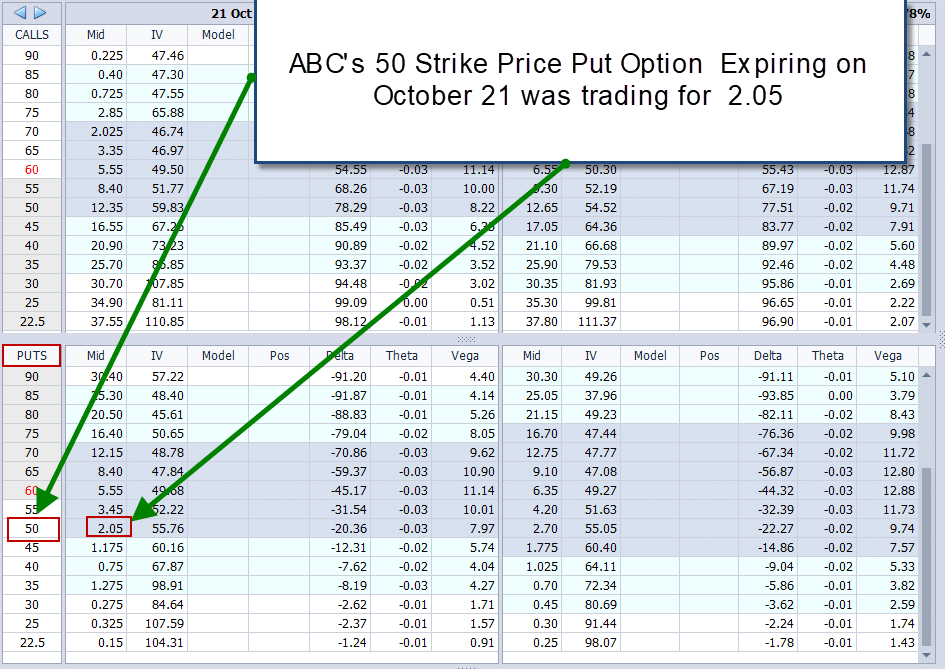

So for example, suppose that ABC stock is trading at around 60 on August 1. Suppose a trader owns 100 shares of XYZ and wants to buy protection for those shares so that if the stock goes down below 50 before October 21, he can sell those shares for 50 no matter how low the stock goes. In that case then he could buy the 50 put for $205—the 2.05 options premium times 100–representing his 100 shares.

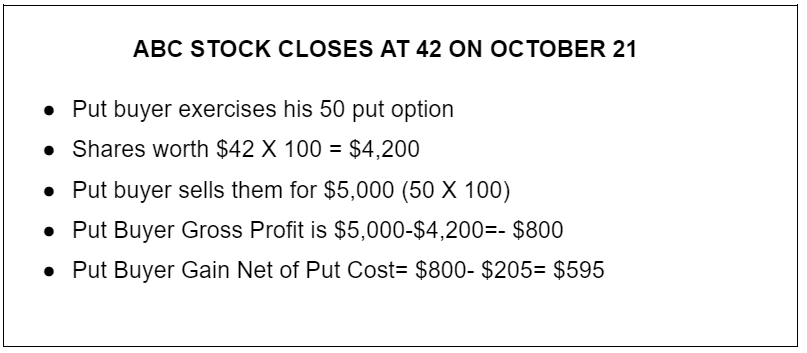

Now, if the stock closes at 42 on October 21, then he can exercise his put and sell the shares for 50, which is 8 points more than they are worth on the open market. So he saved $800 on a gross basis–$8 for each of his 100 shares. Factoring in the cost of the put, $205, the put buyer is $595 better off than had he never bought the put.

On the other hand, if XYZ rallies from its current price of 60 and closes at 68 on October 21, then the one who took the bet, the put seller, gets to just pocket that premium because the 50 put option, again, expires worthless. Why? Well who would want the right to sell shares at $50 when in the open market he can get $68 for those shares? Obviously that right is worthless, and so the option has no value and it simply expires worthless.

On the other hand, if XYZ rallies from its current price of 60 and closes at 68 on October 21, then the one who took the bet, the put seller, gets to just pocket that premium because the 50 put option, again, expires worthless. Why? Well who would want the right to sell shares at $50 when in the open market he can get $68 for those shares? Obviously that right is worthless, and so the option has no value and it simply expires worthless.

Stock options at Expiration

When a stock option expires, your broker will take a look at the option and determine whether it has any value or not. If it’s a call option, and the stock price at closing is “out of the money” it means that the stock is closed at a price lower than the strike price of the call option in which case the option expires with no value and just disappears from your account.

But if a stock closes at a price ABOVE the call option’s strike price, then your broker will automatically execute that option for you in which case, for each call option you own, you’ll receive 100 shares of that stock for which you’ll have paid the strike price of the option for each share.

So for instance, if you own a $95 strike price option for XYZ stock which closes at $98 on the day the option expires, your broker will pay out of your account $9,500 ($95 per share X 100 shares) to the call seller and the call seller’s broker will then deliver to your account 100 shares of the stock worth $9,800 (the $98/per share market price X 100 shares).

In the flukey case where the stock closes EXACTLY at the strike price of the stock on the day it expires, meaning the stock expired “at the money”, then the broker will expire your option with no value because there’s no purpose in exercising the call option to get shares of exactly the same value.

Stock options on puts are the exact opposite. If the stock closes below the put’s strike price then 100 shares of that stock will be sold from your account and you’ll be paid the put’s strike price for each of those shares, regardless of how low the stock’s closing price was on the day the put option expired.

It’s also important to realize that stock options are generally “American Style Options” meaning that an equity put or call option can be exercised at any time from the moment you buy it until it expires. That’s an important distinction because, as we’ll get into later, some options can’t be exercised until they expire. Those kinds of options are known as “European Style Options”.

In any event, if an equity option expires, your broker will automatically exercise it if it has value as we just explained in the previous examples.

What’s the difference between owning stocks and owning options?

Aspect |

Stocks |

Options |

| Definition | Ownership shares in a company. | Contracts that give the option buyer the right to buy or sell a stock. |

| Rights | Shareholders have ownership and voting rights. | Option holders have no ownership or voting rights. |

| Expiration | Stocks don’t expire, they always have some value if the company is perceived by investors to have value. | Options have an expiration date and the owner or the owner’s broker must execute or sell the option before it expires to get any value for it. |

| Dividends | Shareholders may receive dividends if the company pays. | Option holders don’t receive dividends. |

| Risk | Limited to the amount invested in the stock. | Limited to the premium paid for the option. |

| Profit Potential | Unlimited, based on the stock’s performance. | Unlimited on the upside with much greater return potential than stocks due to the inherent leverage of options in the case of a call, Limited only if the stock’s value falls to zero in the case of a put. |

| Leverage | No leverage, you buy shares at their market value. | Leverage is inherent in options trading, magnifying gains and losses. |

| Strategies | Buy and hold, short selling. | Various strategies like buying and selling calls, covered calls, spreads, straddles, strangles, etc. |

| Flexibility | Limited flexibility in terms of strategies. | More flexibility in constructing complex strategies |

| Complexity | Straightforward buying and selling process. | Can be more complex if options strategies involving multiple options are traded at the same time. |

Okay, so now that you know how options work on stocks, let’s move to how options are used to make “bets” on entire equity indexes such as the S&P 500 or the Dow Jones Industrial Average.

But before we do that, if you’re really interested in options trading you need to check the free intensive workshop we’re currently running. In it you’ll discover:

- The unique options trick that allows you to make money while you wait to buy stocks or ETFs at the price you want (one of Warren Buffett’s secret techniques).

- The options income strategy that allows you to make consistent money whether the market goes up, down, or sideways.

- How to make money on a stock or index trade even if you’re outright wrong on the direction (the stock can do the exact opposite of what you predict, and you’ll still win).

It’s 100% free, so reserve your options workshop seat now.

Call Options On Indexes

Similar to stock options, a call option on an index is a bet on an entire index. The buyer of the index call option pays a premium (again, 100 times the option’s price) for a bet that pays off if the index gets beyond the strike price of the call. The call seller is the one who takes that bet. If the call buyer is right, he gets a cash payment of $100 for every point that the index exceeds the call’s strike price on expiration day. If he’s wrong, the seller pockets the premium, just like with stock options.

The buyer of an index put option gets a payment of $100 for every point the index is below the put’s strike price on the day it expires. If the put buyer is wrong, the seller, again, just pockets the premium.

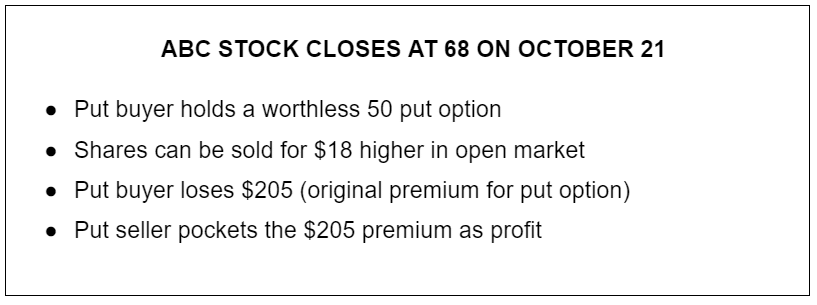

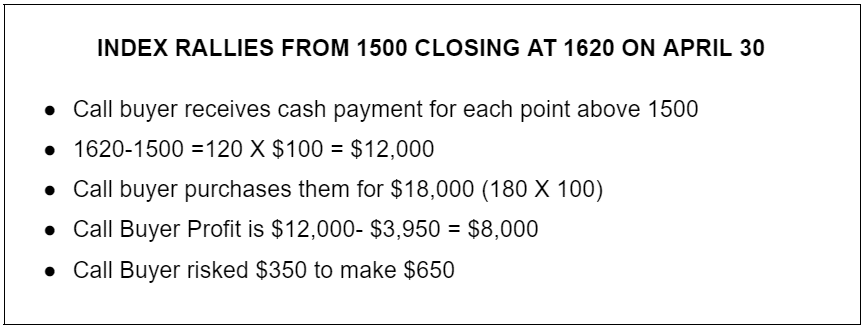

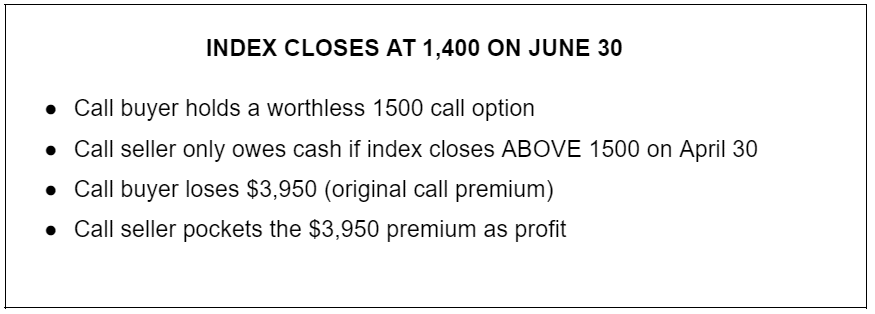

So for instance, suppose that an index’s value on March 1st is 1445 and the trader becomes bullish on that index. And suppose that the 1500 call, 55 points above the current price, which expires on April 30, 60 days later, is trading for $39.50. Well in that case, if he wants to make a bullish bet by purchasing the 1500 call, he has to pay 100 times that, or $3,950.

If the index rallies to beyond 1500 by expiration day, to say 1620, then the call option seller will have to pay the owner of that call $100 for each point above 1500. In other words, the call seller owes the buyer $12,000. And his profit is the $12,000 cash payment minus the original $3,950 cost of the option for a net profit of $8,050.

If on the other hand the index sells off to 1400, then the call option has no value, the call seller owes nothing to the call buyer and therefore the call expires worthless and the call seller pockets the $3,150 that he was originally paid.

Put Options On Indexes

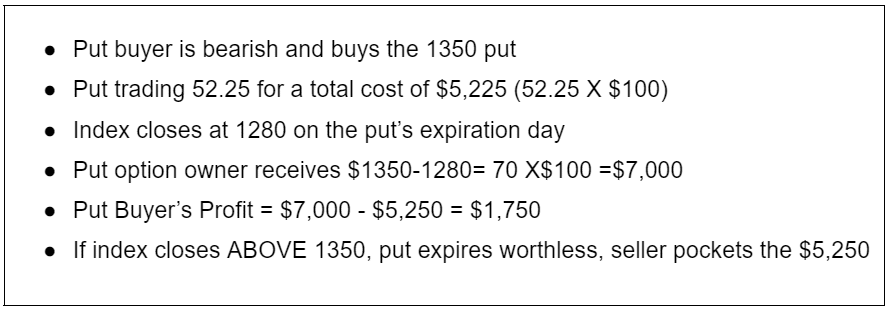

Put options on indexes are the exact opposite of index call options. Index put options only pay off if the index closes BELOW the strike price of the put option.

So let’s say that an index is trading at 1425 and you buy the 1350 put for $52.25, costing you $5,225. If the index sells off to 1280, then the put buyer owes the put seller $7,000 which means that you’d make a profit of $1,750 after deducting the $5,250 put option cost. On the other hand, if the index closes ABOVE 1350 on the day it expires, the put expires worthless and the put seller, again, just pockets the premium.

Index Options at Expiration

Since you can’t own an index (you can only own shares of the stocks of its components), index options are “bets” that pay off in cash. In other words, index options are “cash settled” at expiration. If you own an in the money index call your broker will automatically exercise that option by retrieving from the call seller the $100 for every point that the index closed above the call’s strike price.

So for example, if an index closes at 3180 and you own a 3150 call option on that index, your account will automatically be credited with $3,000 because the option expired 30 points in the money and therefore you’re entitled to 30 X $100= $3,000 in cash for “winning” that bet. However , if the index closes below the call’s strike price on the day it expires, the option simply disappears with no value.

The exact opposite is true of index put options. If the market closes below the put option’s strike price your broker will credit your account with $100 times the number of points the index closed below your put’s strike price.

How often can I make options trades?

Options expire periodically and for each expiration date the major options exchanges offer “options chains” for the options of that asset expiring throughout the year. Back in the day, the major exchanges only offered options expirations once a month, which expired on the third Friday of each month.

But in the first decade of this century the major options exchanges started to offer options chains across a large swath of stocks and indexes which expire every Friday. Eventually certain indexes (such as the SPX and NDX indexes) and the exchange traded funds based on those indexes (such as SPY and QQQ) introduced daily options expiration dates.

The options market over the years has created a vastly greater number of opportunities to trade options contracts than when they first became publicly available in the 1960s, giving traders an incredible opportunity to be more targeted and granular in their trading strategies.

How are Options Priced?

Call Option Prices:

If you buy 100 shares of a stock and the stock goes up $2, it’s pretty obvious that you’ve made $200 on that stock. But if you own a call option on a stock and the stock goes up $2, how much money do you make?

Well the true answer to that question is, “I don’t have enough information to answer that question”. And that’s because a call option’s price will change differently depending upon three different factors:

- Strike Price: How far is the strike price of the option from the current trading price of the stock? Is it 20% above the current price? Is it 1% above the current price? Is it below the current price? For call options the higher the strike price, the cheaper the option. That’s because the higher the strike price, the less likely that the stock will reach that price before the option expires and so the market doesn’t value the opportunity to buy at that price before expiration as very valuable, because it’s not very likely.

- Expiration: How far into the future does the call option expire? Does it expire tomorrow? Does it expire in a month? Does it expire in a year? The farther out in time the call’s expiration is, the higher its price will be. A later expiration allows the stock’s price additional time to reach that price and so the market values that call option more than an option at that same strike price, but less time to reach it.

- Volatility: How volatile is the stock’s price? Is it the kind of stock that has huge swings in price, or is it relatively stable? Volatile stocks have price spikes and price drops that are much more violent and frequent than low volatility stocks. A volatile stock is more likely to trigger a call option, reaching it before or at expiration than a low volatility stock which tends to grind up (or down) in a slower and more orderly way, so volatile stock call options will be more valuable than their counterpart options on less volatile stocks all other things being equal.

- All of these factors can be summarized in this table of call option pricing:

Call Option Pricing

Lowest Priced Higher Priced Highest Priced Strike Price Way above Stock Price At or near strike price

Way below stock price Expiration Very soon Moderately far into the future

Far out in time Volatility Low Moderate Substantial

Put Option Prices:

Once you understand call prices, put prices become really easy to understand. And that’s because put price valuations only differ from call prices in one respect. If the stock to which it relates goes down, then, all other things being equal, the put prices goes up. Why?

Well let’s think of an example. Suppose that a stock is trading at $75/share and you buy a 70 put for that stock? Well if the stock goes down to 71, then the put price, all other things being equal, will go up because the chances of that put having value on the day it expires, which would be at any price below 70, have obviously just increased if the stock went from 5 points above the option’s strike price to 1 point above the option’s strike price.

And that’s because the value of having a contract, a put option, that gives you the right to sell your shares at 70 even if the stock goes to 40 obviously just went up if the stock has downward momentum and may go farther. No matter how low it goes, that put option allows you to have certainty that you can get at least $70 per share for the shares.

So other than moves in the price of the stock, every other aspect of put and call pricing are the same. Just as with calls, the farther out in time the option expires, the more price you’ll get for the call option. And just as with calls, the more volatile a stock’s price is, the higher the put’s price will be. And so put pricing can be summarized in a very similar table as the call option summary we gave you earlier:

Put Option Pricing |

Lowest Priced | Higher Priced | Highest Priced |

| Strike Price | Way below stock price | At or near strike price | Way above stock price |

| Expiration | Very soon | Moderately far

Into the future |

Far out in time |

| Volatility | Low | Moderate | Substantial |

By the way, if you’re enjoying this article but want even more in-depth options education that covers all the basics but also gives you specific, practical strategies that you can easily employ yourself (even if you’re a beginner), head over to OptionsClass.com. It’s completely free.

Why Buy Stock Options Instead of Stocks?

Every time a trader decides that they are bullish or bearish on a stock, it would pay to check the options chains related to that stock to make sure that it doesn’t make more sense to buy a call or put option on that stock instead of buying or selling short those same shares. Here’s an example:

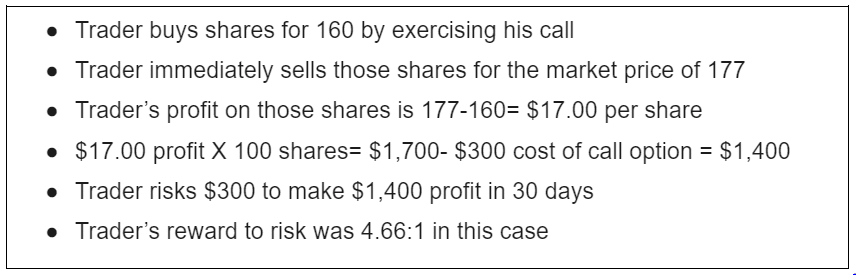

Suppose that a stock is trading at 157 and there is a 160 strike price call option that expires 30 days out trading for $3.00 for which he’ll pay $300 as we have explained (incidentally this is a real example of a real stock and its options). Now if the stock never reaches 160 by the time the option expires, then the trader will lose $305 which was the risk he was taking on this trade. It can never get any worse than the $305 he paid up front. But suppose that 30 days later, the stock closed at 177 on the day the 160 call option expired? Well let’s do the math:

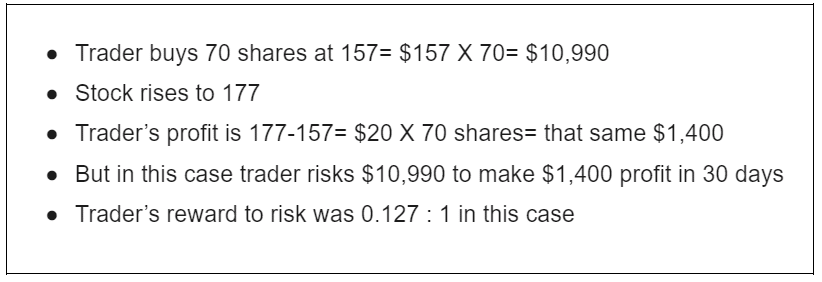

Now let’s compare that to the risks and rewards of buying shares of stock. To attain the equivalent $1,400 profit as the trader achieved through the option transaction, he’d need to buy 70 shares at that original 157 price that the stock was trading at. Let’s look at the calculation from there:

Additionally, while the risk reward is substantially worse with the share purchase transaction, there is the flat out fact that the trader has to come up with $10,990 in the case of the shares while he only needs to have $300 in cash in his account to make the call option trade. This leverage that is achieved with options contracts make a huge difference to aspiring traders who may not have the capital available to make larger trades.

Buying Options

If you think about it, when you’re trading stocks or pretty much any other asset, there are really only two very broad classifications of trades– buying stocks (which makes you “long” those stocks) or selling stocks (which makes you “short” those stocks).

But with options, it gets much more interesting. Because with options you can either trade them as single options (such as buying or selling a call) or you can trade them in combinations, what options trader refer to as “complex orders” which, despite their names are not really that complicated at all. Complex orders are just combinations of different options traded simultaneously in a single order and to make this happen you need to execute what the options market calls a “complex order ticket”.

When you buy a call on a stock, you may have realized by now that while you can effectively profit from the movement of hundreds of shares of a stock for a fraction of what it would cost you to outright BUY those shares, there’s a kind of cost to that. And that is that there is a hurdle to you making any money at all on the option until you have gotten past a certain hurdle which is the cost of the option itself.

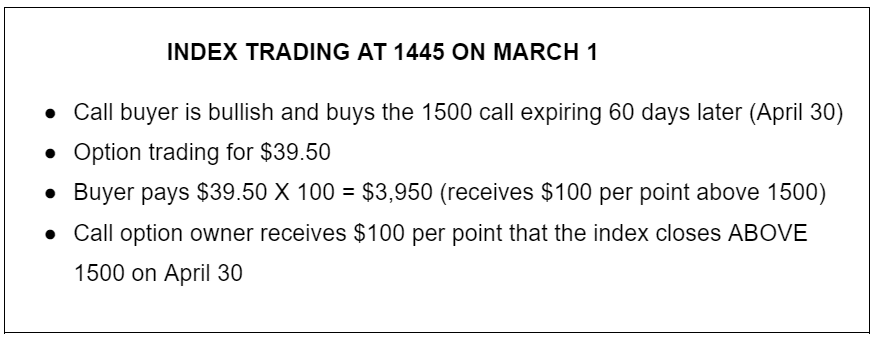

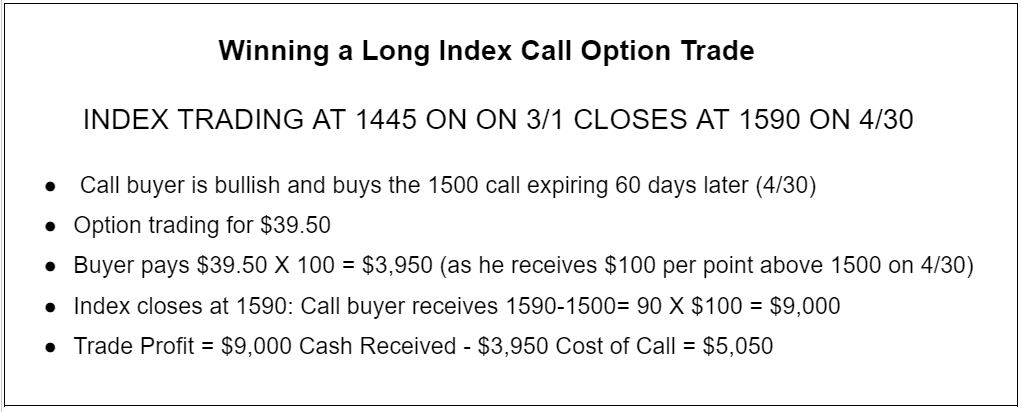

To illustrate this point, let’s go back to the index call option example we were discussing earlier, where the index was trading at 1445 on March 1st and we bought a 1500 call expiring on April 30th for $39.50 so he has to pay 100 times that, or $3,950.

If the index rallies and closes beyond 1500 by expiration day, say to 1590, then the option seller will have to pay the owner of that call $100 for each point above 1500. In other words the seller owes the buyer $9,000. And so the profit on the trade is $5,050 because the $9,000 he received from the call seller exceeded the price the call buyer paid.

But let’s take another case now which is going to be very important to understand. Let’s say that we were right and the index did indeed rally but instead this time the index had gone up to 1520 and stopped. Well in that case, the call buyer gets paid $2,000. (20 points beyond 1500 X $100 per point) but remember he paid $3,950 for the call. So he actually LOST $1,950 by buying that call ($3,950 call cost minus $2,000 call proceeds).

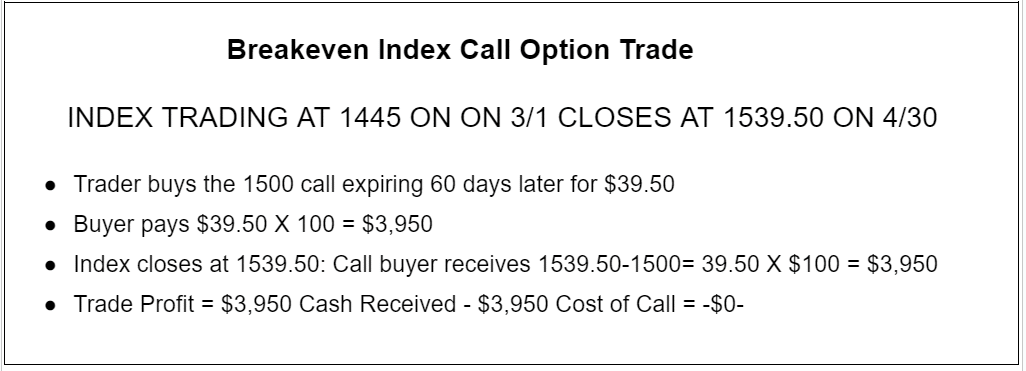

So that brings up a crucial principle for you to remember. If you buy an option, you won’t make ANY money on it until the price of the option exceeds the strike price by the amount of the premium you paid for the option.

So in that last example, for the index trading at 1445 on the day you bought the option, if you buy the 1500 call for $39.50, then you won’t make any money until the index hits 1539.50 which is the 1500 strike price plus the $39.50 call price. In other words, the breakeven on the trade is 1539.50, a full 39.50 points above the point where the call actually begins paying off.

Now this is a big deal, why? Well, think about it. The seller (the one taking the bet) makes money at any price below 1539.50. The call buyer on the other hand must be right by ENOUGH to cover the premium that he paid in order to make ANY money on the trade at all. So, ironically you can be right about the market’s direction and STILL lose money buying an option.

When you are long an option, it’s not enough to be right about the market’s direction. You need to be right by enough to cover the original options premium that you paid.

And so it obviously follows then that the call seller can be very wrong about the direction of the market and STILL make money. It’s amazing if you think about it. To breakeven, the index in this example had to rally 94.50 points , from 1445 to 1539.5, for you to simply BREAKEVEN on buying that call.

Whereas the call seller makes money on any price below $1539.50. So that means that the market can rally more than 94 points and the call seller still makes money even though he took the other side of your bet that the market will go up. In other words, the call seller can be wrong by 94.49 and STILL makes money on the trade.

Selling Options

And so if you think about what we just said, while you do get terrific leverage from buying options, the real edge in options trading is selling options. Think of it this way. There are only five possible outcomes of for example an index call option trade:

- The index goes down a lot.

- The index goes down a little.

- The index doesn’t move at all.

- The index rallies a little.

- The index rallies a lot.

So now let’s look at each of those scenarios in light of buying that 1500 index call option. When,

- The index goes down a lot, YOU LOSE the cost of the call.

- The index goes down a little, YOU LOSE the cost of the call.

- The index doesn’t move at all, YOU LOSE the cost of the call.

- The index rallies a little (to as high as 1539.49) YOU STILL LOSE because you didn’t cover the $39.50 cost.

- Only if the index rallies more than $39.50, the cost of the call, only in that ONE case, do you win.

And so investors all over the world, once they learn options trading, and the edge from selling options, have an amazing array of strategies available to them that can take advantage of the simple principle that you win selling options in four out of the only five cases that can happen as we just illustrated. So what are some of the most popular options strategies?

Below we give you an overview of several options strategies, but if you want to learn the specific ins and outs and walk away with something practical that you can start using right away (simple even for beginners), check out the free intensive workshop we’re currently running.

Options Selling Strategies

Covered Calls

Covered call “writing” is the most popular options strategy and that is for one simple reason: Most investors own at least SOME stocks in their portfolios and while some stocks certainly do pay dividends, the fact is that the average dividend of the stocks that comprise the S and P 500 index is somewhere between 1-2%.

Well that is simply not enough for some investors who are looking for their investments not just to grow, but to provide current income as well. And that’s where the covered call strategy comes in. Here’s how it works:

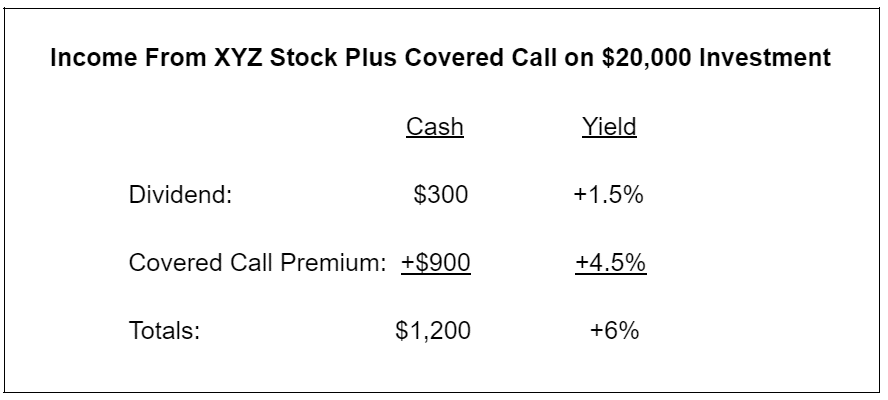

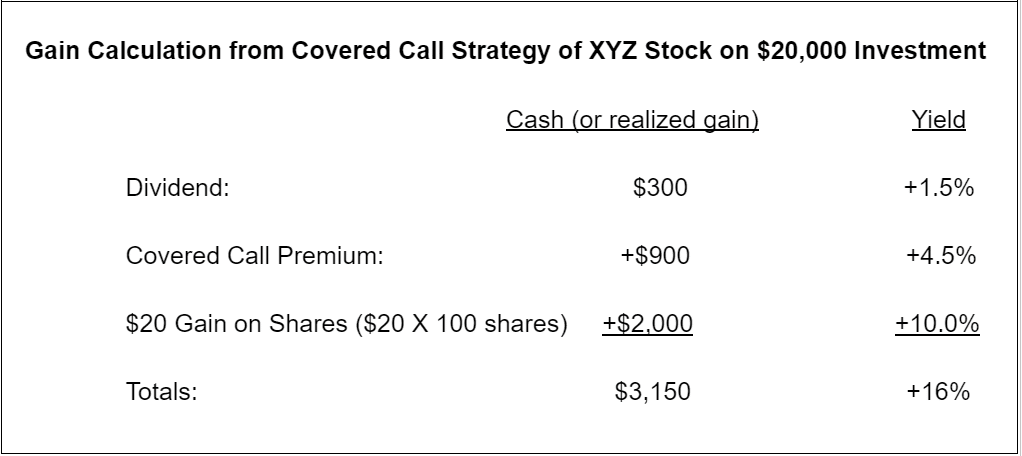

Let’s say that you own 100 shares of stock XYZ which is trading at 200 and therefore the value of your shares of XYZ is $20,000. Now suppose that this stock pays a dividend of $300 per year. Well that comes out to a dividend of 1.5%, right around the average of S and P 500 stocks.

Now let’s say that you are somewhat bullish on the stock and you estimate that the stock could go up as much as 20 points, 10% over the next year but you wouldn’t anticipate that it would go much higher than that. And so you pull up an options chain that expires in one year and you see that the 220 call option is trading at $9.00. Now if you sold that 220 call expiring in a year then you’d receive $9.00 X 100= $900 in cash. In addition over the course of that year you’d receive dividends totalling $300. Adding up the covered call premium that you received and the dividend you would have received results in your receiving a total of $1,150: And so as a result you’ve immediately quadrupled the income that you can make through your ownership of XYZ stock from 1.5% to 6% simply by selling the covered call “against” your shares!

Now you may be wondering why this strategy is called “covered call writing”. Well first off all, any time that you sell an option you are said to be “writing” that option. “Selling options” and “writing options” are the same thing. But what’s the “covered” part all about? Well to understand that, let’s considered the only two things that could happen as an outcome of this trade:

If, by the expiration date a year later, XYZ Company’s stock price remains below 220, the call option will expire worthless. In this case, you keep the $900 premium as profit, in addition to the $300 in dividends.

On the other hand, if the stock’s price closed above $220 on expiration, then the call option will get exercised by the call buyer, in which case you’re obliged to sell your 100 shares of XYZ Company at $220 per share. While you will miss out on any potential gains beyond $220, you still get to keep the $900 premium you received earlier.

And so this potential for your shares to be “called away” is why this strategy is referred to as a “covered call”. The shares you own “cover” your obligation to sell the shares at 220 if the call gets exercised, which almost certainly will happen if the stock closes above 220 on the day the option expires.

Now it’s very important for you to focus on the fact that once the shares are called away, you won’t own them any longer because you would have sold them at $220/share to the call buyer. And depending upon your tax situation, you may also be required to pay a capital gains tax on those shares, which is very important point to keep in mind if you decide to sell covered calls against shares of stock you own.

On the other hand, it’s not exactly a bad thing if the stock rallies 10% and your shares get called away. In fact, if you measure your full gain for the year it turns out that you’ll have managed a 16% gain on your ownership of XYZ stock that year when you consider the dividend, the covered call premium and the appreciation of the shares themselves:

Now, while this is obviously an attractive strategy, it’s important to keep in mind that if that stock rallies past your expectations, you are giving up all of the upside above the strike price of the covered call, while maintaining all of the downside of stock ownership if it doesn’t.

So it’s extremely important to set your covered call at a strike price where you’d be perfectly happy to move on from that stock at the strike price. If you’ve set the strike price correctly, then the covered call is a kind of a win-win situation. Either you collect extra income on your investments or you exit those investments at prices that you consider attractive to you anyway. Plus you KEEP the covered call premium whether your shares get called away or not.

Credit Spreads

Now we’ve discussed why the sellers of options have an edge because of the numerous ways that they can win an options trade. But the downside of course is that if they lose, they can lose big and in some cases very big. So for instance, if you sell an index put option on an index you think will go up but the stock instead goes down and passes through your put’s strike price and closes, say 30 points below that strike price, then you would owe $3,000 (30 points X $100 per point) to the put buyer.

And so to prevent a loss that can get out of hand, options traders developed a strategy known as a “credit spread” to build a stop right into the trade’s initial structure.

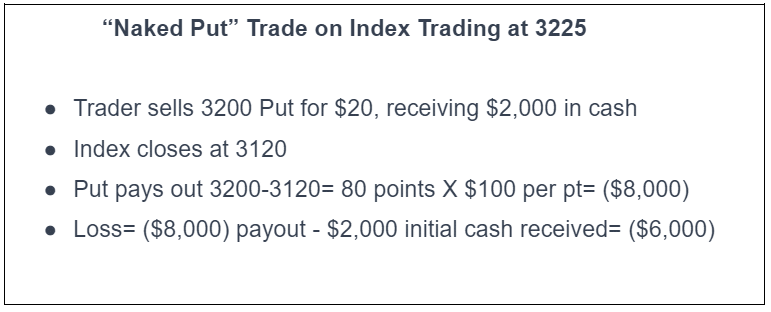

Let’s give you an example of how this is done. Suppose an index is trading at 3225 and you think that the index will go up so you decide to sell a 3200 put on that index , a little bit below the price of the index, expiring in 30 days, and you receive a premium of $20 for that, so you’ll receive $2,000 cash in your account (20 X $100). If the index at least stays above 3200 by expiration day, you’ll just collect the full premium and pocket it because the put will expire worthless.

Now, in this first case you’ll do nothing to protect the trade, which would be called a “naked put”. Now suppose that the stock closes at 3120 on expiration day, 30 days later. Here’s the calculation:

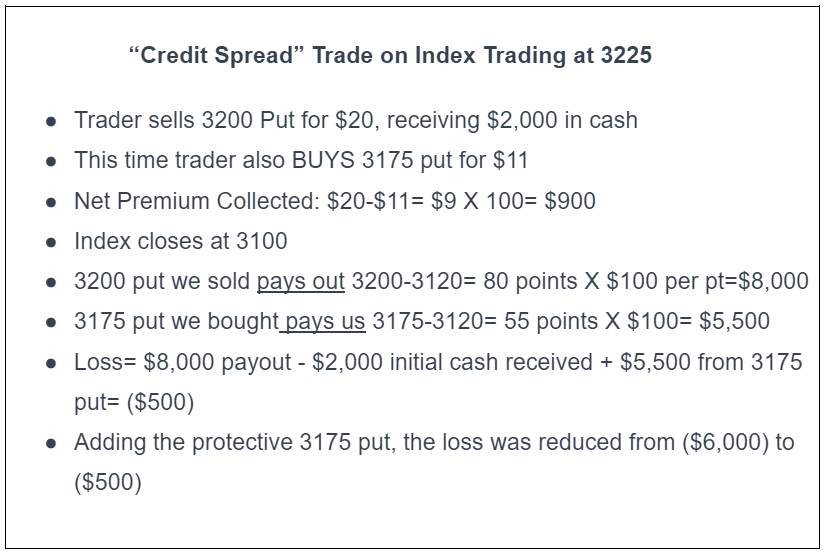

But suppose that the trader instead decided to protect the trade and enter into a “credit spread”. A put credit spread is when you sell a put option on a higher strike price and BUY a put option on a lower strike price. Since the put that is lower will be cheaper (it’s less likely the index would drop to the level of the lower strike price than it would to drop to the higher strike price) then you’ll still collect cash for the transaction, but you’ll receive less because out of some of that cash you receive you’ll be using to pay for a cheaper option lower down, reducing your income. So in this second case, we’ll instead enter into a credit spread, and you’ll see how that provides built in protection so the trade loss doesn’t get out of hand reducing the loss in this case from ($8,000) to only ($500):

And so as you can see, credit spreads are a MUCH safer way to create income by selling options as the risk management of the trade is built into the trade itself. As soon as the index reaches the long option (the one we bought) , the long option increases in value for us, point for point negating any further loss created by the short option, effectively stopping the loss on the trade.

Credit spreads can also be executed if you think an index or stock will go down. For this you’d enter into a “call credit spread” which is just the opposite of a put credit spread. In the case of a call credit spread, you would sell a call with a lower strike price and buy a call with a higher strike price, hoping the price in this case goes down. The lower call that you sell will be more expensive than the higher call you buy resulting again in a credit spread, in this case a call credit spread.

Again, if the stock or index goes up, i.e. you were wrong, then the long call protects the loss on the short call from getting out of hand just as the long put protected the short put from getting out of hand in the case of the put credit spread.

The advantage of credit spreads is thus the built in protection of buying the long option at the same time you buy the short option. The disadvantage is that you’ll receive less net premium than simply selling the naked option because of the cost of the long option. That’s the tradeoff.

On our trade desk we strongly discourage naked options, instead opting for credit spreads, particularly overnight, where very large moves can take place and without the built in stop, the position becomes very dangerous. Credit spreads are a much safer way of getting the benefit of selling options, those 4 out of 5 winning scenarios we discussed earlier, without taking undue risk.

Market Neutral Options Selling Strategies

Buying and selling calls, buying and selling puts, trading covered calls and selling credit spreads are all strategies which do best when the market goes in a certain direction.

For example, if you buy a call, or enter into a covered call you’ll get your best outcome if the market rallies. If you buy a put or sell a call credit spread, your best outcome is a market sell-off. And that’s true of almost every other trading vehicle–your best outcome is when the direction you’ve predicted is the outcome that actually takes place in the market.

But with options you have another choice–market neutral options selling strategies–a whole category of strategies that make money, regardless of whether the market rallies or sells off, as long as the market stays within a certain price range. With market neutral options selling strategies all you need to get right is the range of prices and you’ll win the trade.

And with certain strategies these price ranges can be huge and thus have an extremely high win rate, as high as 80% or higher, way above what you could be reasonably expected with other trading styles. These strategies include very popular strategies such as straddles, strangles, iron condors, butterflies, calendar spreads and double diagonals.

We cover more strategies in step by step detail on OptionsClass.com. It’s free to reserve your seat for our intensive workshop, so why don’t you head over there and check it out?

Getting Started Trading Options

Now that you’re aware of the incredible flexibility and power of options trading strategies, some of you might be pretty excited about getting started and so there are a number of important steps that you should consider before you jump in.

Choosing an Online Options Trading Broker Platform

Most ordinary financial advisors and stock brokers will neither have the expertise nor the inclination most likely to accept your orders to place options income strategies and so as a result a large industry of online brokers has emerged, to serve traders who want to self-direct their trading of options strategies

Some of those brokerage platforms were specifically designed around the needs of independent retail options strategy traders. Here are the specific characteristics you should be looking for at a minimum in order to hone in on which options brokerage platform would be the most suitable for you:

Options Chains with Detailed Options Strategy Order Menus: Any brokerage platform that does not have a clearly laid out module in which options chains of all major indexes and stocks are available should be immediately eliminated from consideration. Further, there should be, readily available, a menu of the most common options strategies which, when pulled up, are automatically pre-filled with options laid out according to the details of that strategy. Iron condors, butterflies, calendars, diagonals and vertical spreads should all be available through those menus.

Detailed Profit Graphs Displaying the Risk and Rewards of the Trade:

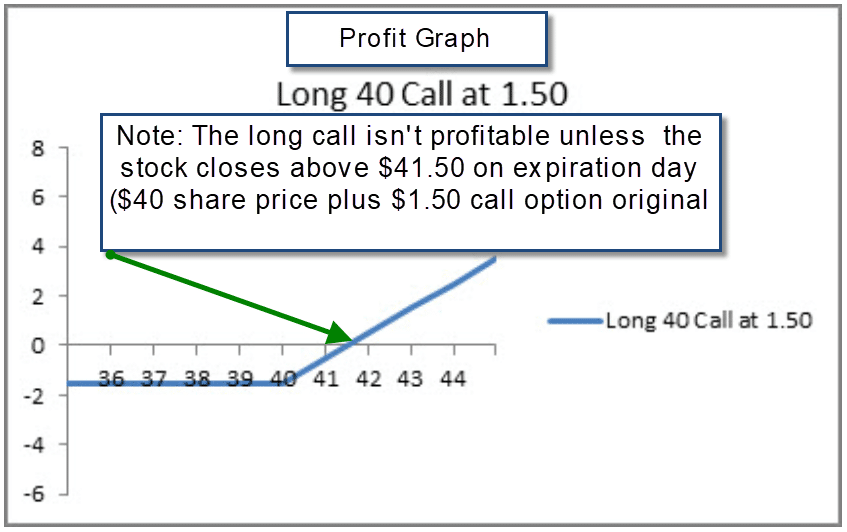

“ A picture is worth a thousand words” and this principle is quite true of options trading strategies. For example, this is what a profit graph would look like for a long call which graphically demonstrates how much profit a long 40 call on a stock with a cost of $1.50 is worth at various closing stock prices on the day the call option expires:

Online brokers which have profit graphs that demonstrate graphically the positions that the trader is actively trading provide a major advantage to the trader, particularly as the positions become more complex and the trader will need the graph to highlight the risks and rewards of the trade at a glance.

Options Greeks: Options prices change depending upon a number of factors such as the price of the index or stock that the option is related to, the volatility of the price of that index or stock and the amount of time until that option expires. The “options greeks” measure how sensitive a particular option is to each of these factors and as you become more experienced you’ll learn the importance of the greeks and use them in your decision making.

All you need to know at this point is that your broker must display those on your broker platform. The most important greeks are “delta, theta, vega and gamma”. If your broker platform doesn’t have column choices for those greeks, then that broker is not satisfactory for trading options.

Commission Rates and Structures: Most major options-oriented online brokers are quite aware of their competition and attempt to be as competitive as possible in the market. But finding the cheapest broker may not at all be in your best interest particularly if a broker is lacking in the key platform characteristics we just discussed (full order ticket menus, detailed profit graphs and the greeks).

Having said that, the key cost issues to compare between brokers are:

- Commissions: Online brokers have a wide range of prices per options contract, but typically they are anywhere from 15 cents to $2.00 depending upon the size of an account and the number of options contracts being transacted. Some options brokers do not charge anything per options contract, in which case the broker is obtaining their revenue exclusively from the order flow that they are sending to market makers or exchanges. However you must be aware that brokers in this category may have very limited capabilities.

If your options broker, as most do, charge a per contract commission for each trade, and if you trade a substantial amount of transactions in a month, almost all brokers are negotiable as to their charges and you should make sure to probe into that before making a final decision. Commissions are charged for both entering and exiting an options transaction and thus you have to consider these “roundtrip” charges when assessing the economics of a trade. At least one major broker has decided to waive its exit fee on an options trade, only charging commissions for entering the trade initially. - Ticket Charges: Some brokers charge a minimum amount for each transaction known as a “ticket charge” in addition to their commissions per contract. Those brokers, as a commercial trade-off, may well charge less for commissions per options contract above the ticket charge. If your broker uses ticket charges, you must think through how many options contracts you are likely to transact at any given time and whether your effective commision rate will actually be higher, when considering the ticket charge, than other brokers in the market who offer higher commissions but no ticket charge.

For instance, if your broker has a $10 ticket charge and a 20 cent commission, if you trade one options contracts, your effective commission is $10.20 for that one options contract! You’d be alot better off with a broker that charges a $1.50 commission rate per option in that case. - Flat Monthly Fees: Some brokers will charge a flat amount for a month and no commissions per transaction. Depending upon how active you plan to trade your account, this could be a very attractive option, provided that the broker has all of the other requisite capabilities.

- Exchange Fees: There are a large number of potential fees that an online broker can charge you in addition to the base commission rate that they advertise. These can include clearing fees, regulatory fees, exchange access fees, options exchange fees and exchange membership fees. Some brokers quote you a very cheap per options contract commission rate but then load many of these additional fees on top of that providing for some unpleasant surprises when you have completed a transaction.Other brokers embed all fees within its stated commissions (in which case you are not charged for them explicitly). We can’t emphasize enough how important it is to clarify how these fee are handled when you are considering establishing an account with an online broker.

- Market Data Fees: In order to be able to transact options with your online broker, you will have to have access as to what the current market pricing is for each option you are trading as well as the asset from which those options are derived (stocks, indexes, currencies, etc.). Options exchanges provide real-time market data, including quotes, order book information, and historical data for each options chain publicly available. To access this information for you, online brokers may pass on market data fees to their clients. The fee amount can vary based on the level of data required, such as “basic” or “advanced” market data packages that you’ll need to choose when you first establish an account with an online options broker. So think through carefully which options you’ll be trading and only ask for market data that allows you to trade those particular options and whatever other data you need to make your trading decisions and don’t get caught up in signing up for the endless amounts of available data feeds, many of which you will rarely if ever need to actually use in your trading.

- Assignment Charges: Some brokers charge fees for exercising an option, while others don’t. It is important to check that particular broker’s policy on that subject. For instance, if a short equity call closes in the money, brokers will automatically sell your shares of the stock in question to the owner of the call at the call’s strike price. That’s an example of the “exercise” of an option and some brokers will charge for this transaction while others will not.

Popular Options Trading Platforms: Most active options traders use one of these three platforms as they are all excellent in all of the minimum requirements that we detailed above:

- Think or Swim

- Interactive Brokers

- TastyTrade

There is a growing number of high quality options trading platforms and when comparing platforms, each of these issues should be carefully weighed before selecting your online options trading broker.

Obtaining a Solid Education on Options Fundamentals

This article, while comprehensive, is just a start. To become a competent and successful options trader, you’ll need a much more elaborate understanding of the major options strategies, their capital and margin requirements, how they can be tweaked and modified, the options greeks and other very important topics. Without taking a comprehensive course in the fundamentals of options trading, there is a very high probability that you’ll inadvertently put yourself into dangerous trading situations with no firm understanding of the risks of the position you have entered. That is a recipe for disaster.

Back Testing and Paper Trading Strategies

It’s our experience that traders need to experiment with each of the strategies that they are interested in through the use of back testing software that allows you to “simulate” having traded the strategy using real historical options pricing data from the past. Back testing gives you confidence in your strategy, helps you to understand its strengths and weaknesses and provides you with the simulated experience of winning and losing trades and understanding the flow of each strategy. Without back testing, you’re not prepared for live trading because you haven’t practiced the strategy in a simulated way, which is a bad mistake.

Once you’ve back tested a strategy then we recommend your “paper trading” the strategy for a sufficient length of time to get a feel for how your broker platform works as to that strategy. When you’re live trading with real capital, the last thing you’ll want to do is to be fumbling around learning the ins and outs of your broker platform while your trading capital is at stake.

You need to be able to operate your broker platform as a second nature activity for you. Navigating the market shouldn’t be complicated by the fact that you haven’t mastered your broker platform. Paper trading is the best way to master your broker platform. Each major broker provides you with a paper trading account within which you can practice. Don’t make the mistake of not taking advantage of that.

When you do finally begin to trade live capital in your account, TRADE SMALL. For a while. You’re going to make mistakes, you’re going to make execution errors, you’re going to experience different emotions, most of which are counterproductive to successful trading. While you’re working out all of these issues, the last thing you want to be doing is discouraging yourself by having each mistake magnified because you unnecessarily traded too large, when you are still learning and essentially in training.

You MUST trade live capital to learn how to be a successful trader, but you don’t have to trade large to get that experience. Most traders think of any losses they may experience in their initial year of trading as “additional tuition”. And that’s a good way of looking at it. So keep your “tuition” costs low and trade small.

How Much Capital Will I Need to Fund My Options Account?

Most online brokers will inquire as to your knowledge of options trading prior to granting you options trading permission (which is another important reason to acquire a solid understanding of options fundamentals before you consider trading options with your hard earned capital). Once they’ve qualified you, you may only need to fund your account with as little as a few thousand dollars.

However, that can be a misleadingly low number because if you are more than minimally active you will be subject to what are known as “pattern day trading” rules which means that the broker’s risk management software will “think” that you are day trading options (even if you are not) and will automatically limit the number of trades that you can make in any trading week unless you fund your account with $25,000 or more. So unless you plan to make a minimal number of options trades in any given week, you should think of $25,000 as a minimum amount with which to fund your options trading account.

Options Trading FAQ

Top 10 Questions for Options Trading Beginners:

- What is options trading?

The best way to think of options are “bets” wagering on whether a particular stock, index, currency or futures contract will go up or down in value by a certain date. Options contracts are traded publicly on major options exchanges. - What are call and put options?

A call option is a bet that an asset, like a stock, will go UP in value. A put option is a bet that an asset will go DOWN in value. - How do options contracts work?

Options contracts are of two types.” Call options” and “put options”. A buyer of a call option on a stock for example is making a bet that the stock is going to go up beyond a certain price which is known as the “strike price” of that option, by a certain date which is known as the “expiration date of that call option”. For that bet he pays what is called a “premium” equal to 100 times the price of the option as quoted on the options exchange where it trades. The call seller is the one taking that bet and receiving that premium. If the call buyer is right, he is entitled to buy 100 shares of the stock at the strike price of the option, even if the stock has moved much higher than that price. If the call buyer is wrong, the call seller pockets the premium that the buyer paid him in exchange for taking that bet. Put options on stocks work similarly, but in the case of the buyer of the put option, he is betting that the stock price of a stock that he owns will go down. If the put buyer is right, he is entitled to sell 100 shares of the stock at the strike price of the put option, even if the stock has moved much lower than that price. If the put buyer is wrong, and the stock closes above the strike price of the option, the put seller pockets the premium that the seller paid him for taking that bet. - What is the difference between options and stocks?

Stocks are shares of, usually, publicly traded companies and the owner of a share of stock is actually an owner of a percentage of that company. A stock option is a bet, in the form of a contract that allows the option buyer to either buy shares of the stock at a fixed price until some point in the future, or sell his shares at a fixed price at some point in the future. The owner of a stock option is not in any way a partial owner of a company. He is the owner of a contract that gives him the right to buy shares of a company in the case of a call option, or the right to sell shares of a company, in the case of a put option. - How do I start trading options?

In order to start trading options you should get a solid education in the fundamentals of options trading, open an account with an online broker, fund that account with the broker’s required capital for options trading. It is advisable that you utilize the broker’s “paper trading” account (that all online brokers will grant when you first open your account) to familiarize yourself with the flow of options trading and how to execute orders on your online brokers platform. Once you start trading actual capital, it is imperative to trade with a minimal amount of risk for an extended period of time so that you can become accustomed to how options prices respond to different market environments. - What are the basic strategies for options trading?

The basic strategies are to buy calls to bet that an asset’s value will rise in value or buy puts to bet that an asset’s value will decrease in value.

Another major options strategy is to SELL options to buyers of call or put options in order to collect the “premium” that options buyers pay for making their bets. Generally speaking, options sellers are taking the “other side of the bet” wagering that the call buyer’s asset will go down and that the put buyer’s asset will go up. Call sellers are required by their brokers to put up collateral in the form of cash or some other asset (such as stock) to cover their financial exposure to the bet if the call buyer proves to be right. - How are options priced?

Options pricing is a complex subject and mathematical formulas have been developed to predict options prices based upon three major factors in this case of stock options: where the strike price of the option is in relation to the stock’s current price, the expiration date of the option, and how volatile the stock’s price movements are. - What is the role of an options broker?

Options brokers execute clients orders to buy and sell options contracts and assist and maintain a client’s minimum account requirements in accordance with regulations surrounding options trading. Some options brokers also provide education and training on the broker’s options trading online platform and options trading principles themselves. Some brokers also provide research and analysis that is helpful to client trading in the financial markets. - How can I manage risk in options trading?

One of the beauties of buying and selling options is that the risk of a trade is limited to the premium that the option buyer pays for that option. Those premiums, in the case of stock options, are often a tiny fraction of the cost of the stock itself, limiting the risk and capital outlay of the option trader.

Sellers of options on the other hand are exposed to a very large amount of risk because, for example the seller of a put option is required to buy shares of a stock that may have sold off far past the strike price of the put option, causing the trader’s account to pay far more cash for shares of stock than they are worth, resulting in the trader’s account being marked down substantially. - What are the best resources for learning about options trading

Options trading education is available online through numerous channels, but there are many sources that can’t be trusted because the instructors aren’t actually professional traders. By contrast, SMB Capital is one of the longest lasting and most successful proprietary trading firms in the world, and as such you know that our education comes from real-world experience and robust strategies used by legitimate professional traders. If you’d like to learn more about options trading sign up for our 100% free online workshop here.

Taking Action

You’ve learned a lot in this article, but all the knowledge in the world won’t help you unless you take action. The most efficient and effective way to do that is to take advantage of our free options workshop by visiting OptionsClass.com.

In the free intensive workshop you’ll learn:

- The unique options trick that allows you to make money while you wait to buy stocks or ETFs at the price you want (one of Warren Buffett’s secret techniques).

- The options income strategy that allows you to make consistent money whether the market goes up, down, or sideways.

- How to make money on a stock or index trade even if you’re outright wrong on the direction (the stock can do the exact opposite of what you predict, and you’ll still win).

- Reserve your free seat now.

The post The Only Options Trading Guide a Beginner Will Ever Need (The Basics from A to Z) appeared first on SMB Training Blog.