AUDUSD slips over growth worries

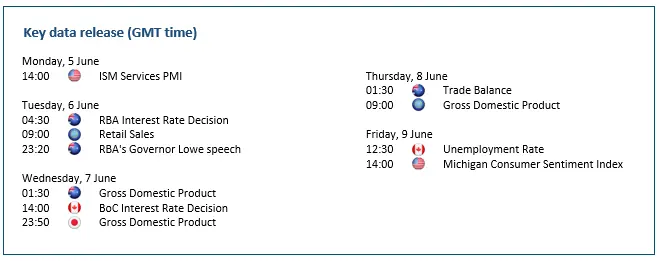

The Australian dollar tanks as soft Chinese data reduces risk appetite. Sluggish commodity markets due to growing concerns about China’s demand weigh on overall sentiment. A slump in prices of iron ore and copper, Australia’s main exports put its currency under pressure. Bullish advocates would turn to the RBA meeting after the consumer price index rose 6.8% in April fuelled by sticky energy and housing prices. The central bank may be inclined to raise interest rates again as soon as possible, which could offer some floor to the sliding exchange rate. The pair is drifting towards 0.6400 and 0.6820 is the first resistance to lift.

USDCAD awaits BoC decision

The Canadian dollar recoups some losses as another BoC rate hike could be on the agenda. GDP growth in the first quarter came out much stronger than expected, raising the bets that the BoC will hike this week for the first time since its pause in January. The prospect of narrowing yield spreads between US and Canadian bonds could offer the loonie some respite. Volatility in the price of oil, one of Canada’s major exports, has been a major headwind for the currency, but any news supportive of the commodity out of the Vienna meeting could boost the loonie’s appeal. 1.3250 is a major floor and 1.3650 the immediate resistance.

UKOIL slips over gloomy demand

Brent crude struggles to stabilise as the demand outlook from top consumers remains uncertain. Weaker manufacturing activity in China, the world’s top oil importer, would put a question mark on demand sustainability. Across the Pacific, Fed officials have suggested that interest rates could be kept on hold in June. This pause signal may help the price regain a foothold in an oversold market. the OPEC+ meeting will shed lights on whether further production cuts will be in the pipeline, but while the supply side may induce volatility, the demand narrative remains a key driver. 70.00 is a critical support and 80.40 the closest hurdle.

SPX 500 rallies in hope of a Fed hike pause

The S&P 500 advances as investors hope the Fed will let the rate hikes sink in before making another move. Inflationary pressures and restrictive financial conditions have taken a toll on spending. Retailers are feeling the pinch and have flagged a cautious outlook for the year. On the macro side, signs of a loosening labour market could weigh more on the balance. A higher unemployment rate and weaker hourly earnings point to slowing wage pressure, making inflation less sticky. If the Fed sees the intended effect taking hold, a pause in the hiking campaign would become reality. 4310 is the resistance to break with 4050 as a key support.

The post The Week Ahead – Intended effect appeared first on Orbex Forex Trading Blog.