-

After a strong 2023, Tesla starts 2024 on a very weak note

-

Price cuts and other negative developments weigh

-

Yet, it has the most expensive valuation within the ‘Magnificent 7’ group

-

The EV giant announces results on Wednesday, after the closing bell

Is another drop in earnings looming?

Tesla’s stock made an impressive start in 2023, surging from a low of around 113 to a high of 281 in July. And although the performance during the remaining months was more subdued, the stock secured annual gains of more than 100%.

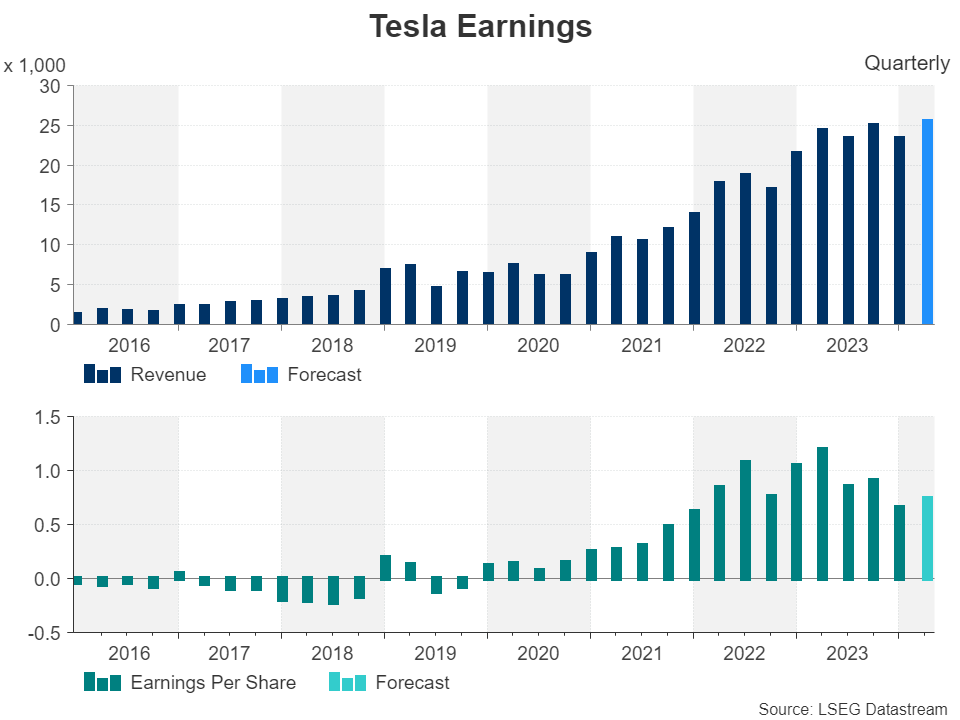

The price-reduction policy the firm adopted has led to a surge in deliveries during the first two quarters of the year, but it was followed by a decline in the third quarter, with the firm reporting a modest 8.8% revenue growth. Its earnings-per-share ratio was $0.66, marking a decline of around 37% compared to the third quarter of 2022.

The electric vehicle pioneer will report its results for the last quarter of 2023 on Wednesday after the closing bell, and it is expected to announce EPS of $0.74, reflecting another sharp drop of nearly 38% on a year-on-year basis, while revenue is seen increasing to $25.52bn, which will mark an only 5.16% increase from the same period last year.

Deliveries for Q4 came in at around 485k, helping the firm achieve, and slightly exceed, its annual target of 1.8mn vehicles. But, while the number was better than analysts expected for the quarter, it was not enough to help the company surpass China’s BYD Co. in global sales of electric cars.

Negative developments weigh on the share price

The start of the new year was not rosy at all, with the stock losing more than $94bn in market value in just the first two weeks of 2024 as negative developments kept succeeding one another.

On January 11, Hertz Global Holdings Inc announced that it is planning to sell a third of its US electric vehicle fleet and reinvest in gas-powered cars due to weak demand and higher repair costs. Just the next day, Tesla cut prices again in China and suspended production at its lone European factory in Germany for two weeks, citing a shortage of parts due to shipping delays caused by the turbulence in the Red Sea. A week after China’s price cuts, the EV carmaker slashed prices of its Model Y cars across Europe.

And as if all this was not enough, Chief Executive Elon Musk posted on social media that he is uncomfortable growing Tesla to be a leader in AI and robotics without having 25% voting control, adding that unless this is the case, he would prefer to build such products outside Tesla.

The most expensive within the ‘Magnificent 7’

From a valuation’s perspective, Tesla has the highest forward price-to-earnings (P/E) among the ‘Magnificent 7’ group, although that multiple has slid to around 57.6x from 66.5x on December 26. From a performance perspective, the EV giant is the worst performer since October, when the latest stock rally began.

This suggests that the overvalued price of this share may indeed represent expensiveness now and not the present value of future growth opportunities. Such opportunities may have already been reflected in the stock price and most of them may have already been translated into success.

With that in mind, the true value of Tesla now likely rests in hopes that it will develop the first truly self-driving cars. However, the firm has been promising this for years, something that could prove harmful at some point in the future if there is no concrete progress.

Are more declines in store for the EV giant?

Even if Tesla announces better than expected results on Wednesday, that may not be enough to turn the tide for its stock price. Investors have already begun lifting their implied Fed rate path higher, which weighs on present values of high-growth tech firms that are usually valued by discounting projected cash flows for the quarters and years ahead. Ergo, for Tesla’s outlook to brighten, the EV giant may need to announce not only better numbers of the last quarter of 2023, but stronger profitability growth projections.

From a technical standpoint, Tesla has been in a tumbling mode since December 28, when it hit resistance at $265. The stock fell below the near-term uptrend line drawn from the low of October 31, and continued drifting south, piercing through both the 50- and 200-day exponential moving averages (EMAs), and below the $228 key barrier.

If investors are not willing to pick up the stock near current levels, the slide may extend towards the low of November 10 at $206, the break of which could carry extensions towards the low of October 31 at 195. For the picture to turn positive, a recovery all the way above $265 may be needed.