High-Frequency Trading (HFT) refers back to the use of highly effective computer systems to execute a big quantity of trades at lightning velocity. HFT Prop EA, or High-Frequency Trading Proprietary Expert Advisor, is an automatic buying and selling system that makes use of algorithmic methods to make buying and selling choices. In current years, the impression of HFT Prop EA on market volatility has been a scorching matter of debate amongst merchants and regulators.

Effects of HFT Prop EA on Market Volatility

Proponents of HFT Prop EA argue that it offers liquidity to the market, making it simpler for merchants to purchase and promote securities. They additionally declare that HFT Prop EA helps to cut back bid-ask spreads, leading to decrease buying and selling prices for traders. However, critics of HFT Prop EA argue that it may well exacerbate market volatility by amplifying worth actions and inflicting sudden market crashes.

One of the methods through which HFT Prop EA impacts market volatility is thru its skill to detect and exploit market inefficiencies in real-time. By utilizing complicated algorithms, HFT Prop EA can shortly react to altering market situations and execute trades at a velocity that’s inconceivable for human merchants. This can result in speedy worth fluctuations and elevated market volatility.

Another method through which HFT Prop EA can impression market volatility is thru the phenomenon often known as “quote stuffing.” Quote stuffing refers back to the follow of flooding the market with a big quantity of orders to create the phantasm of liquidity and disrupt the buying and selling methods of different market individuals. This can result in elevated volatility and create a difficult buying and selling surroundings for different merchants.

Regulatory Responses

In response to considerations in regards to the impression of HFT Prop EA on market volatility, regulators have applied varied measures to mitigate its results. For instance, some regulators have launched minimal resting occasions for orders to forestall rapid-fire buying and selling methods that may contribute to market instability. Others have applied circuit breakers to halt buying and selling during times of excessive volatility.

Despite these efforts, the talk over the impression of HFT Prop EA on market volatility continues to rage on. Some argue that HFT Prop EA performs an important function in offering liquidity and effectivity to the market, whereas others warning in opposition to the potential dangers it poses to market stability.

Conclusion

Overall, the impression of HFT Prop EA on market volatility is a posh and ongoing situation. While proponents argue that HFT Prop EA offers liquidity and effectivity to the market, critics elevate considerations about its potential to exacerbate market volatility. As regulators proceed to grapple with these points, it’s clear that HFT Prop EA will stay a controversial matter on this planet of high-frequency buying and selling.

FAQs

What is HFT Prop EA?

HFT Prop EA stands for High-Frequency Trading Proprietary Expert Advisor. It is an automatic buying and selling system that makes use of algorithmic methods to make buying and selling choices at lightning velocity.

How does HFT Prop EA impression market volatility?

HFT Prop EA can impression market volatility by shortly reacting to altering market situations, creating speedy worth fluctuations, and interesting in practices like quote stuffing that may disrupt market stability.

What are regulators doing to deal with the impression of HFT Prop EA on market volatility?

Regulators have applied measures similar to minimal resting occasions for orders and circuit breakers to mitigate the consequences of HFT Prop EA on market volatility.

Recommended Broker

Trade with a Trusted Global Broker ==⫸ XM

- Platform: Metatrader4, Metatrader5, C Trader

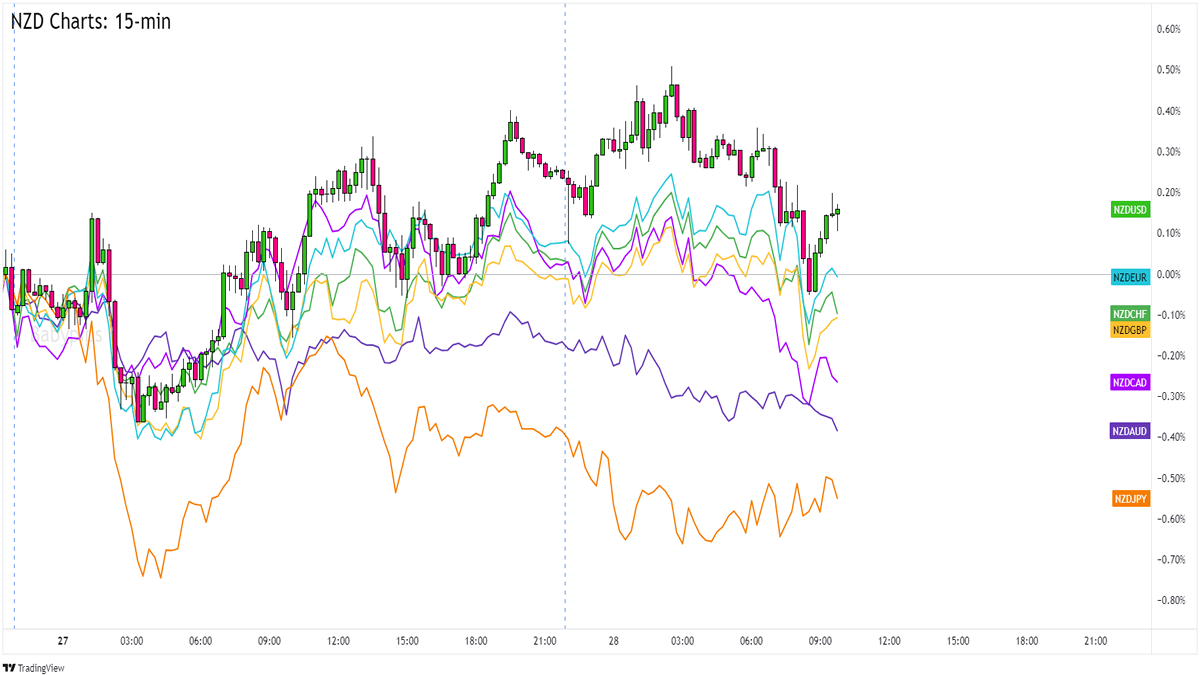

- Currency pairs: NZDUSD, USDCAD, AUDNZD, AUDCAD, NZDCAD, GBPCHF, XAUUSD (GOLD), BTCUSD (BITCOIN)

- Trading Time: Around the clock

- Timeframe: M5, M10, M15, M30, 1H, 4H, 1D, 1W

- Minimum deposit: $100

- Recommended vendor: XM

Sign in to Download this Indicator

The post The Impact of HFT Prop EA on Market Volatility appeared first on FOREX IN WORLD.